The tide seems to have turned for Advanced Micro Devices (NASDAQ:AMD), which has been riding a bullish wave since hitting a 52-week low-point in early April.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, its share price has jumped by roughly 50% during the past few weeks, thanks in large part to calming trade tensions and a reaffirmation by the hyperscalers that AI capex spending remains on track.

This has been welcome news indeed for AMD investors, who had to wade through a rough stretch starting in the second half of 2024. Their patience appears to have been rewarded, and two recent developments seem poised to provide further tailwinds for AMD’s share price.

AMD was among those American businesses represented during President Trump’s visit to Riyadh, with CEO Dr. Lisa Su joining a slew of tech luminaries at the U.S.-Saudi Business Summit. During her visit, Dr. Su unveiled a “$10 billion initiative to scale an open, global AI infrastructure” with the Saudi Arabian AI enterprise, HUMAIN.

AMD also announced a $6 billion share buyback program – which now gives the company roughly $10 billion in buyback authority.

Noting the “16 billion positive signals” from Saudi Arabia and the increased buyback authority, one top investor known as Stone Fox Capital is gung-ho on AMD’s prospects – though the investor believes the bull case extends beyond these two events.

“The big investment story in AMD is the upside potential due to the disconnect in market share in the AI GPU space,” explains the 5-star investor, who sits in the top 4% of TipRanks’ stock pros.

Stone Fox notes that the AI story is now moving into its inference phase, which stands to benefit AMD. The investor points out that the company boasted 57% growth in its Q1 data center sales which totalled $3.7 billion – “a new record high for the seasonally slow quarter.”

In addition, AMD’s MI350 GPU stands to be quite competitive against Nvidia, with Stone Fox adding that the HUMAIN deal provides further affirmation that AMD is making inroads against the industry leader.

Despite the recent surge, Stone Fox suggests that AMD’s forward valuation of 20x remains quite reasonable.

“At 20x forward base case earnings, the stock remains undervalued with massive AI upside; the Saudi deal and buyback reinforce the bullish thesis,” summarizes the investor, who rates AMD a Strong Buy. (To watch Stone Fox Capital’s track record, click here)

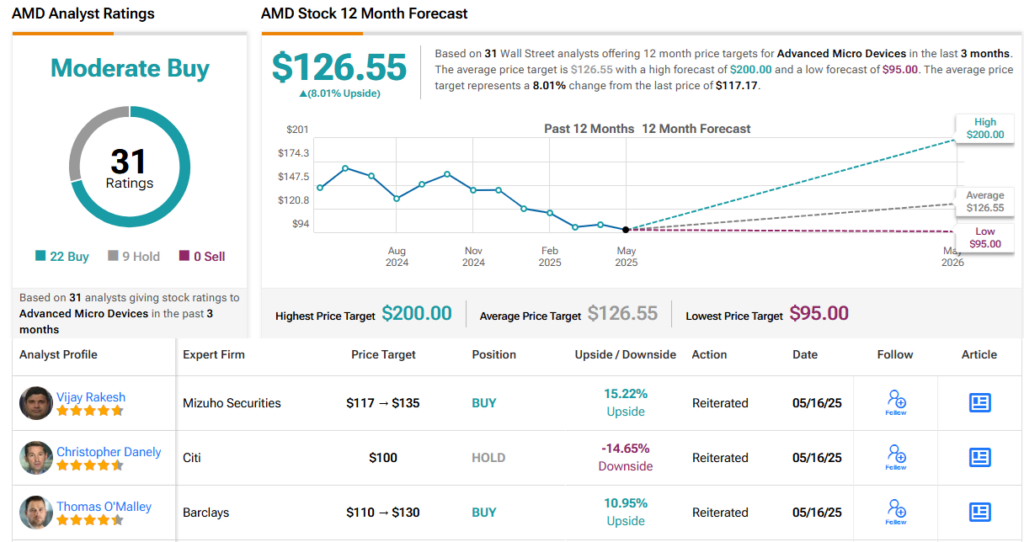

Wall Street seems to agree. With 22 Buy and 9 Hold ratings, AMD enjoys a Moderate Buy consensus rating. Its 12-month average price target of $126.55 has an upside of 8%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.