Reports emerged earlier today about Bill.com Holdings (NYSE:BILL) planning to buy Melio Payments. At this, shares plunged, until Bill itself came out and revealed that such plans weren’t in the works at all. That turned things around, and now, Bill.com is down nearly 9% in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The reports came out early Thursday, even reaching Bloomberg at one point. But after Bill itself came out and said that it was “…not pursuing any such acquisition at this time,” the bottom fell out of Bill’s share prices, careening downward to about 16% lost. It’s recovered since then, certainly, but not fully, as apparently investors were deeply interested in seeing Melio Payments stay out of Bill.com’s hands. The deal was originally said to be a combination of cash and stock valued at around $1.95 billion, which would have been sufficient to make it one of the biggest purchases Bill.com has ever made. Even its purchase of Divvy back in June 2021 came in at $2.5 billion.

It might be for the best that Bill.com didn’t make any big purchases, anyway. Reports note that Bill had $1.84 billion in debt as of September 2023. That’s objectively a huge number, but it’s not so bad in light of the fact it has $2.65 billion in cash available. Thus, a $1.95 billion bill—that likely would have been financed with cash and stock as opposed to debt—likely could have been doable. But given the macroeconomic climate, husbanding cash isn’t a terrible idea until things start to improve a bit. That’s likely particularly true after its disappointing fiscal year forecast.

Is Bill.com Holdings a Buy?

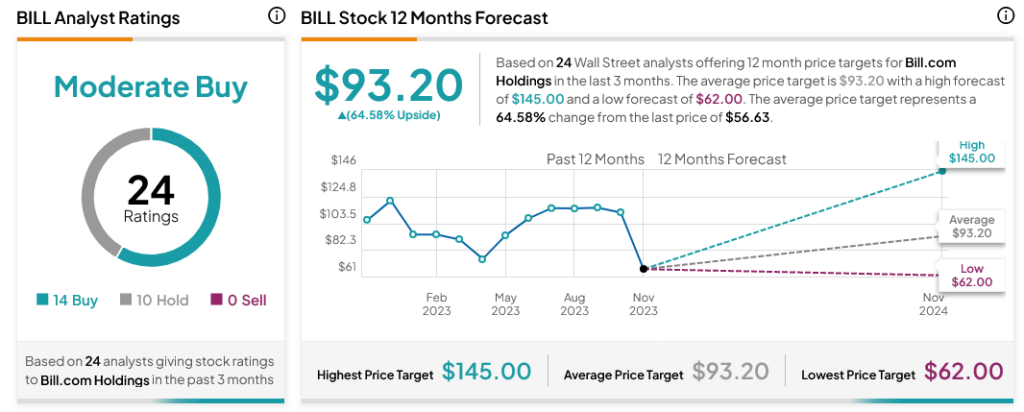

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BILL stock based on 14 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average BILL price target of $93.20 per share implies 64.58% upside potential.