What goes swiftly up can also come down at a rapid pace, as BigBear.ai (NYSE:BBAI) investors learned last week. Shares of the data mining AI company had been on one almighty tear over the month preceding its latest quarterly report. However, once the results were released last Thursday, investors made a 180-degree turn and sent shares tumbling by 32% in the subsequent session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In Q4, revenue remained roughly flat compared to the same period a year ago, hovering at $40.56 million, but falling short of the consensus estimate by $2.19 million. Additionally, the EPS of -$0.14 missed Street expectations by $0.09. Furthermore, due to the completion of the acquisition of its peer Pangiam on March 1, the company refrained from issuing an adjusted EBITDA outlook for 2024.

That said, despite investors showing displeasure with those metrics, it wasn’t all bad. For the second quarter in a row, the company recorded positive adjusted EBITDA, which reached $3.7 million vs. the loss of $2.5 million a year ago and for the first time since entering the market in 2021, the company became cash flow positive in 2H23.

For H.C. Wainwright analyst Scott Buck, perhaps more importantly than the Q4 results, the guide offered plenty to look forward to.

Boosted by the acquisition of Pangiam, on top of a return to organic growth, the company expects 2024 revenue to come in between $195 to $215 million vs. consensus at $173.73 million and improving on 2023’s $155.16 million haul.

According to Buck, these developments signal a company moving in the right direction, presenting a compelling long-term opportunity for investors.

“Improved revenue growth is coupled with ongoing expense discipline and improving gross margin, driving operating leverage,” said the analyst. “As investors take near term operating results and extrapolate future cash flows, and as the business continues to scale, we believe valuation multiples should begin to move toward high-quality AI peers. While some integration noise is likely over the next six months, we believe investors should accumulate BBAI shares ahead of stronger operating results and improved business momentum in 2025.”

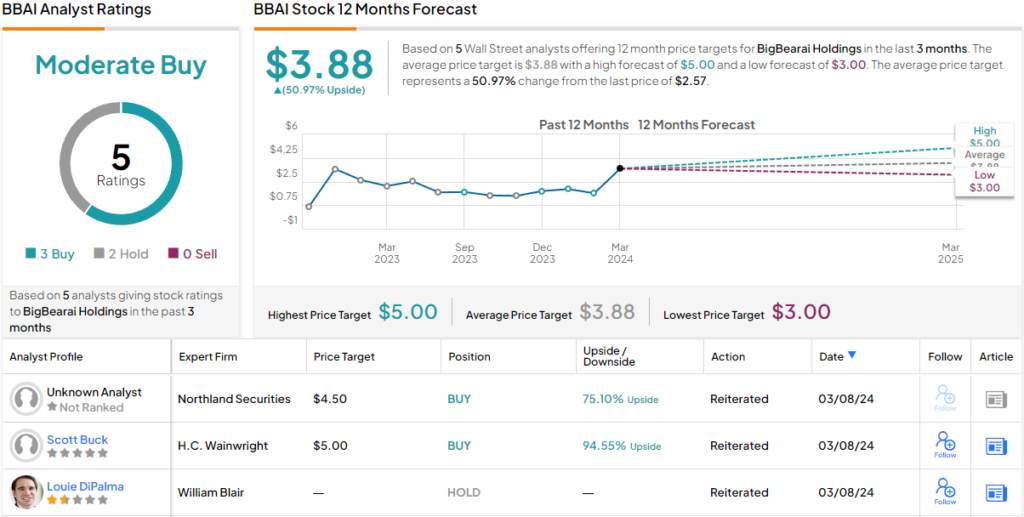

Consequently, Buck raised his price target on BBAI to a Street-high of $5 (from $4), suggesting the stock will gain 95% over the coming months. This reaffirms his Buy rating on the shares. (To watch Buck’s track record, click here)

The rest of the Street is evenly split here with 2 additional Buys and Holds, each, all adding up to a Moderate Buy consensus rating. At $3.88, the average target makes room for one-year returns of ~51%. (See BBAI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.