BigBear.ai (BBAI) is set to release its Q3 2025 financial results on Monday, November 10. Wall Street analysts expect BBAI to report a loss per share of $0.07 for Q3 compared to a loss of $0.05 in the same quarter last year. Meanwhile, revenue is expected to decline 23% year-over-year to $31.81 million. The stock has surged 27% year-to-date and jumped nearly 225% over the past year, driven by optimism around its expanding role in artificial intelligence (AI) and government analytics. However, continuous operating losses continue to cloud the outlook.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A.I. Analyst Cuts Price Target Ahead of Q3

Ahead of the results, TipRanks’ AI Analyst Mira Patchera (under the GPT-4o model) lowered the price target on BigBear.ai to $6 from $6.50, while keeping a Hold rating. The new target suggests about 6% upside from current levels. Patchera explained that the AI analysis shows weak financial trends, including lower revenue and ongoing cash losses. Revenue has dropped due to contract delays, which raises concerns about steady income and future profits. The company’s negative adjusted EBITDA also highlights continued cost pressure and slow movement toward profitability.

Notably, in the previous quarter, BigBear.ai reported Q2 revenue of $32.5 million, missing the Street’s estimate of $40.59 million. It also posted an adjusted loss of $0.71 per share, wider than the expected $0.06 loss.

Even so, Patchera pointed out that BigBear.ai’s strong cash balance—about $390.8 million at the end of Q2—offers the company room to fund growth plans and manage its debt. She also noted that global partnerships are expanding, helping bring in new regional revenue and supporting the company’s broader growth outlook.

Options Traders Anticipate a Large Move

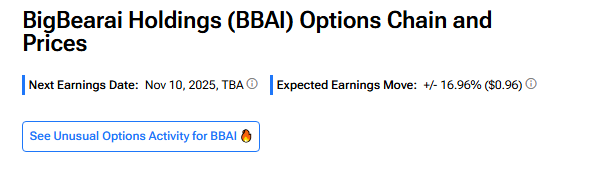

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 16.96% move in either direction.

Is BBAI Stock a Good Buy?

Overall, BigBear.ai Holdings stock scores a Moderate Buy consensus rating based on two Buy and one Hold recommendations. The average BBAI stock price target of $5.83 indicates an upside risk of 3%.