Three days into the strike, and the repercussions for the Big Three American automakers continue to rise. The United Auto Workers (UAW) union won’t budge, and officials at Ford (NYSE:F), General Motors (NYSE:GM), and Stellantis (NYSE:STLA) are unwilling to bow to their high demands. While the UAW seeks a 36% wage hike over the four-year contract, the automakers are stuck at a 20% raise.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Battle With UAW Worsens

In the latest development, Ford laid off 600 workers (non-striking) on the night of September 15, one day after the UAW began their targeted strike. Ford said it had to lay off the workers from the painting and final assembly sections as a direct consequence of the strike. Ford noted that car manufacturing is “highly interconnected” and said that the striking workers had directly affected the jobs of union workers from other incidental departments.

Similarly, GM has cautioned that some 2,000 workers at a Kansas auto plant could be affected by plant shutdowns on Monday or Tuesday as a direct fallout from the strike at the Missouri plant. Both companies have also notified that the laid-off workers will not receive any compensation, which has irked the UAW union even more.

The UAW’s targeted strike involved some 12,700 workers from three factories – GM’s plant in Wentzville, Missouri; Ford’s plant in Wayne, Michigan; and Stellantis’ plant in Toledo, Ohio. As per a Reuters report, GM is the only carmaker to have made progress with the union post the strike. Although the pace of negotiations is slow, reports suggest that the two are moving ahead with discussions. Also, the UAW will likely resume negotiations with Ford and Stellantis on Monday.

The Biden Administration also sent two high-ranking officials to pacify both parties and urged them to return to the negotiation table, but no progress has been made so far. Biden also pressed the companies to equate “record profits” with “record contracts.”

As the days into the strike progress, it could lead to significant challenges at both ends. The automakers are expected to face production and delivery issues, while the union workers could see more layoffs and further days without adequate pay. The politicians have their own agenda at hand as the election year approaches. The Biden Administration is trying to mellow things down for the UAW workers with their outspoken support, thus winning their votes at the election next year.

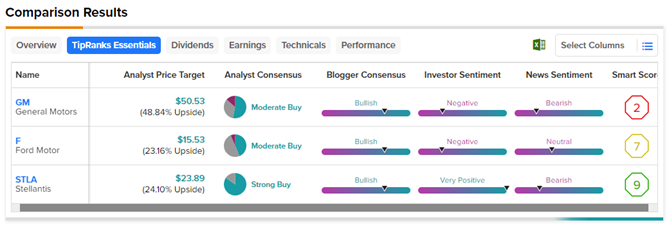

With these points in the background, let’s see where the Big Three stocks stand based on the TipRanks Stock Comparison tool. Notably, Stellantis is the only carmaker to command a Strong Buy consensus rating and earn a TipRanks Smart Score of 9, which implies that STLA stock can outperform the broader market over the long term. However, General Motors has the highest upside potential (48.8%) on the average price target among the three stocks.