In what may be one of the most shocking pieces of news today—and that alone qualifies as a shocker—the Big Three automakers, Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA) were all up in the final minutes of Friday’s trading day. This was despite the active picket lines outside of their plants as nearly 13,000 United Auto Workers union members went on strike. And that brought President Joe Biden out to speak on the matter as well.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Biden, likely smelling the faint scent of an election year just a few months away, came out strongly in favor of the unions. Biden declared that workers should be compensated fairly, opining that “…record corporate profits mean record contracts for the UAW.” Meanwhile, elements of Biden’s cabinet—including senior advisor Gene Sperling and Acting Labor Secretary Julie Su—are out working with both sides to mediate negotiations.

While certainly, not all of the Big Three’s profits find their way into CEOs’ pockets, and there are other bills to be paid besides workers’ salaries, it’s easy to see where some might be concerned. A CBS report pointed out that the average UAW worker pulls in about $28 an hour, all told. Meanwhile, the Big Three’s average CEO pay runs much higher. Jim Farley with Ford took home $21 million, while Carlos Tavares with Stellantis bagged $24.8 million. And Mary Barra at GM grabbed $29 million in 2022. Yet, there’s also some wiggle room with the UAW’s demands as well; a 32-hour work week sounds nice, but the UAW wants it paid as if it were a 40-hour week. And the call for a 40% pay raise only sounds feasible when it’s staged over four years.

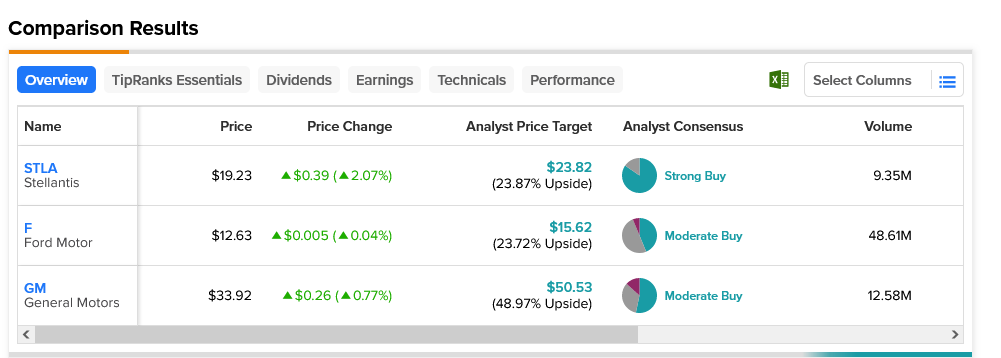

With all three automakers up, the only real distinction comes from their upside potential. Stellantis, a Strong Buy by analyst consensus, offers 23.87% upside potential with its average price target of $23.82 per share. Meanwhile, General Motors offers the strongest upside potential of 48.97% on its average price target of $50.53.