U.S. tech giants continue to use their power to thwart any prospective legislation that would impact their dominance. Millions of dollars spent by big tech on lobbying ensured the exclusion of two antitrust bills (The American Innovation and Choice Online Act and the Open App Markets Act) from the omnibus spending package released Monday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The American Innovation and Choice Online Act aims to prohibit unfair self-preferencing by big tech to undermine competition. Meanwhile, the Open App Markets Act intends to encourage competition by reducing Apple (AAPL) and Google’s (GOOGL) (GOOG) control over the app stores. These bills garnered good support from small tech companies, consumer groups, and Rupert Murdoch’s media companies.

Big Tech’s Lobbying Spree

According to Bloomberg, small tech companies and consumer groups spent $2 million on advertisements in support of the antitrust bills against the tech giants. However, that amount seems minuscule compared to more than $100 million spent by big tech and their trade groups on lobbying since 2021.

Data revealed under the Lobbying Disclosure Act indicates that Meta Platforms (META), Amazon (AMZN), Google’s parent company Alphabet, and Apple spent $35.6 million, $34.2 million, $17.8 million, and $12.8 million, respectively, on lobbying since 2021. Campaigns sponsored by the big tech contended that the antitrust bills would impact national security and user privacy, and lead to content moderation.

Despite their lobbying efforts, big tech continues to face the wrath of the Federal Trade Commission, other regulatory agencies, and the Supreme Court. They are also facing regulatory challenges in international markets. For instance, Apple is reportedly planning to allow customers to use third-party app stores on their iPhones and iPads to comply with European Union requirements.

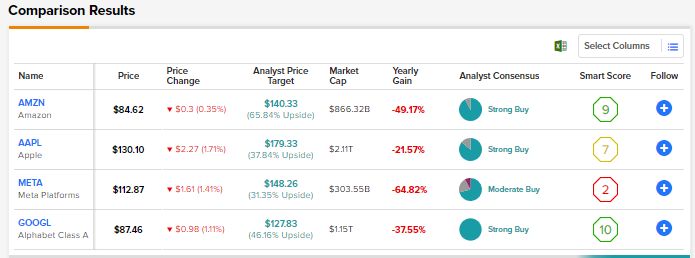

While regulators are watching the moves of big tech critically, Wall Street analysts seem bullish about the long-term prospects of these four stocks, as indicated in the consolidated chart below using TipRanks’ Stock Comparison Tool.