There was another round of big bank earnings today as Goldman Sachs (NYSE: GS) and Morgan Stanley (MS) announced their fiscal Q4 earnings. Let us look at how these banking giants fared in Q4.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Goldman Sachs

The fourth quarter earnings of Goldman Sachs was a big disappointment as the bank reported earnings of $3.32 per share, a drop of 69.3% year-over-year and missing Street expectations of $5.56. GS stock slipped in pre-market trading on Tuesday following the announcement of Q4 results.

Revenues came in at $10.59 billion, a decline of 16% year-over-year and missing consensus expectations by $320 million. The fall in revenues was a result of significantly lower revenues in Asset and Wealth Management and Global Banking and Markets businesses.

Annualized return on equity (ROE) was 4.4% in Q4 while annualized return on average tangible common shareholders’ equity (ROTCE) was 4.8%.

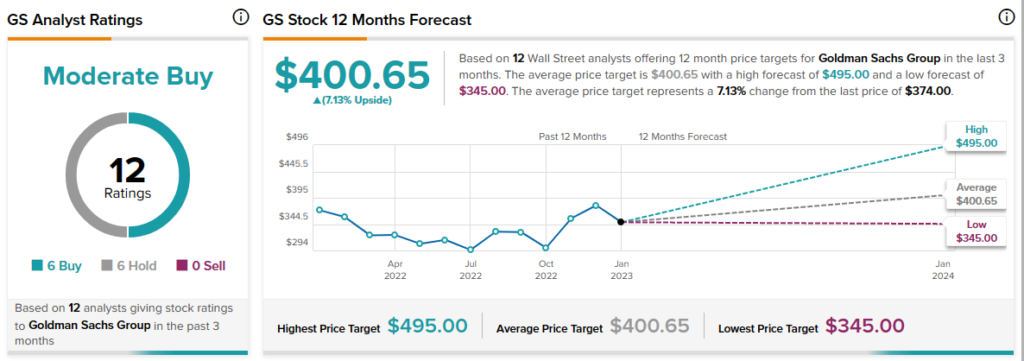

Analysts are cautiously optimistic about GS stock with a Moderate Buy consensus rating based on six Buys and six Holds.

Morgan Stanley

Similar to Goldman Sachs, Morgan Stanley also experienced a decline in Q4 revenues of 12.4% year-over-year to $12.7 billion but still managed to beat analysts’ expectations by $100 million.

Adjusted earnings came in at $1.31 per share in the fourth quarter, versus $2.08 in the same period last year but beating Street estimates of $1.25

In Q4, MS delivered an ROTCE of 12.6%.

Wall Street analysts remain cautiously optimistic about MS stock with a Moderate Buy consensus rating based on seven Buys, five Holds, and one Sell.