It probably shouldn’t come as a surprise that there’s been something of a rivalry between Amazon (NASDAQ:AMZN) founder Jeff Bezos and Tesla (NASDAQ:TSLA) founder and CEO Elon Musk. Both are part of the Magnificent Seven stock package, and both have raced each other to space with various sub-ventures. Now that Jeff Bezos is wealthier than Elon Musk, it’s easy to wonder what else might happen in this ongoing match-up. Nevertheless, EV maker Tesla and e-commerce giant Amazon are down in Tuesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For the last two years and change, Elon Musk sat atop the Bloomberg Billionaires Index, with Jeff Bezos not far behind him. Yet now, in a move not seen since 2021, the positions have flipped, and Bezos is atop the list at $200.3 billion. Meanwhile, a recent decline in the value of Tesla shares cut Elon Musk’s overall wealth to $197.7 billion. Amazon shares have been generally on the rise, fueled by expansive growth during the pandemic and some recent attempts to drive new growth into areas like wireless internet access and even space travel.

Different Entities in Entirely Different Markets

A comparison between the two men is relatively simple; both are driven, hard workers who built their respective companies out of nothing to ultimately become global powerhouses. But the companies themselves are wholly different entities in entirely different markets. Tesla is focused on electric vehicles, though it’s made quite a showing in battery systems as well.

It’s also made some other attempts into comparative novelties like the “not a flamethrower” via The Boring Company and wireless internet access, which Tesla itself is somewhat connected to via the StarLink system.

On the other hand, Amazon sells virtually everything and will soon offer vehicles from Hyundai. Even actual flamethrowers of a kind are available on Amazon, though they’re generally called “propane torches.” Amazon’s significantly greater diversification, even pushing into areas that Tesla itself is involved in, makes it likely a better buy overall.

So Is Amazon or Tesla Stock the Better Buy?

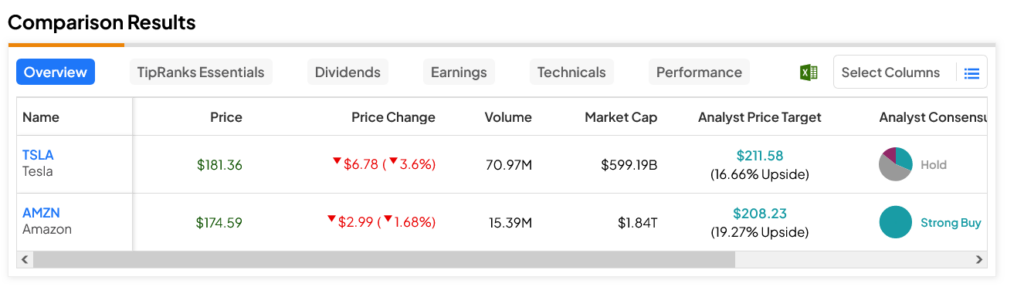

Turning to Wall Street, AMZN is actually the leader among the two, though much like their founders, not by much. This Strong Buy-rated stock offers a 19.27% upside potential against its average price target of $208.23. Meanwhile, TSLA offers only a 16.66% upside potential against its average price target of $211.58.