Veteran plant-based meat products maker, Beyond Meat, Inc. (BYND) released disappointing results for its fourth quarter ending December 31, 2021, due to lower volumes and higher investments in extensive product scaling activities, which dampened its margins. The company even issued guidance that fell short of analyst estimates.

Following the news, shares reversed their intraday gain of 3.4% and plumetted 10.8% during the extended trading session on February 24.

Disappointing Q4 Results

In Q4, BYND reported revenues of $100.68 million, which fell 1.2% year-over-year and even missed analysts’ estimates of $101.36 million. The fall in revenues was primarily due to a 19.5% decrease in U.S. retail channel net revenues, which was impacted by softer demand, five fewer shipping days in Q4FY21 compared to Q4Y20, increased trade discounts, and a marginal loss of market share.

Similarly, Q4 net loss of $1.27 per share was wider than the prior-year quarter loss of $0.40 per share, and came in wider than analysts’ expected loss of $0.71 per share.

For full-year fiscal 2021, Beyond Meat’s revenues leaped 14.2% to $464.7 million and a net loss of $2.88 per share was wider than the FY20 loss of $0.85 per share.

CEO Comments

Commenting on the results, President and CEO of BYND, Ethan Brown, said, “In 2021, we saw strong growth in our international channel net revenues, as well as sporadic yet promising signs of a resumption of growth in U.S. foodservice channel net revenues as COVID-19 variants peaked and declined.”

“As we begin 2022, we are pleased with the progress we are making against our long-term strategy, such as the number of tests and core menu placements recently announced by our global QSR partners. Though we will continue to invest during 2022, we expect to substantially moderate the growth of our operating expenses as we leverage the building blocks we now have in place to serve our customers, consumers, and markets — bringing forward our exciting and expansive future one delicious serving at a time,” added Brown.

Weak 2022 Guidance

The company expects pandemic-related labor issues and supply chain challenges, coupled with softened demand to continue to affect its performance in FY22.

Based on the same, the company guided for full-year fiscal 2022 net revenue to fall in the range of $560 million to$620 million, much lower compared to the consensus estimate of $637.3 million.

Consensus View

Responding to Beyond Meat’s quarterly performance, Jefferies analyst Robert Dickerson assigned a Hold rating to the stock with a price target of $55, which implies 12.2% upside potential to current levels.

Overall, the BYND stock has a Hold consensus rating based on 1 Buy, 7 Holds, and 2 Sells. The average Beyond Meat price target of $63.29 implies 29.2% upside potential to current levels. However, BYND shares have lost 65.9% over the past year.

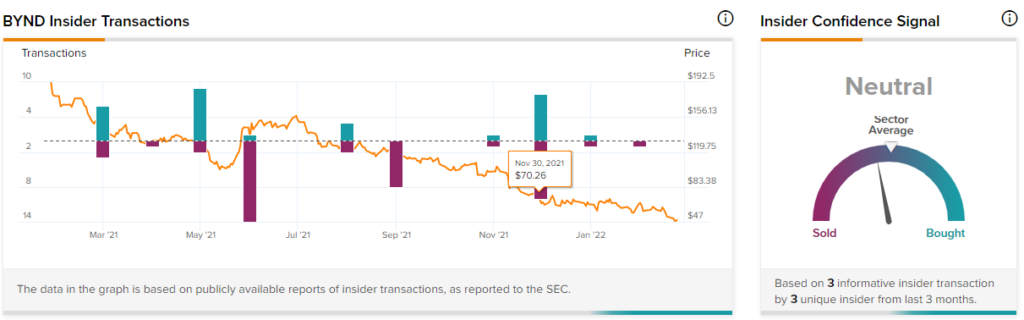

Insider Trading

TipRanks’ Insider Trading Activity shows that Insider Signal is currently Neutral on Beyond Meat, with corporate insiders selling $477.5K shares in the last quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FuboTV Slips 4.5% on Mixed Q4 Results

Lowe’s Jumps 6% on Outstanding Q4 Results

Lemonade Plunges 22% after Q4 Earnings Miss & Weak Guidance