Beyond Meat (BYND), a popular meme stock, has seen its shares fall 63% so far this year due to weak demand for its plant-based meat offerings and ongoing volatility tied to its speculative trading swings. In a new press release, the company said it will now report its third-quarter 2025 results on Monday, November 10, one day earlier than the previously scheduled date of November 11. The change was made to account for the Veterans Day holiday, when the U.S. SEC will be closed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street expects Beyond Meat to post a nearly 16% year-over-year decline in revenue to $68.98 million. Meanwhile, analysts project a diluted loss of $0.40 per share, slightly lower than last year’s loss of $0.41. With earnings just around the corner, it’s worth taking a look at who holds the biggest stakes in BYND.

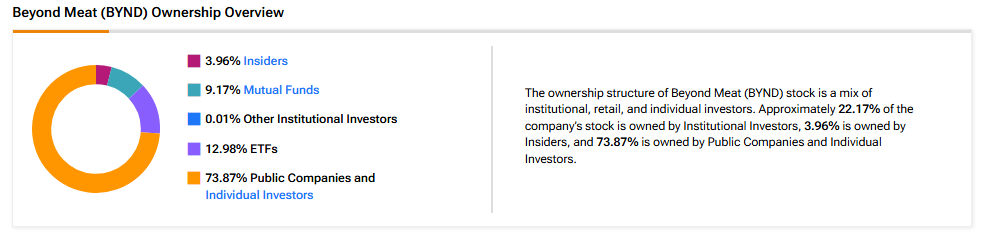

Now, according to TipRanks’ ownership page, public companies and individual investors own 73.87% of BYND. They are followed by ETFs, mutual funds, insiders, and other institutional investors, at 12.98%, 9.17%, 3.96%, and 0.01%, respectively.

Digging Deeper into BYND’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in BYND at 5.45%. Next up is Vanguard Index Funds, which holds a 4.49% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.96% stake in Beyond Meat stock, followed by the SPDR S&P Kensho New Economies Composite ETF (KOMP), with a 2.76% stake.

Moving to mutual funds, Vanguard Index Funds holds about 4.49% of BYND. Meanwhile, Fidelity Salem Street Trust owns 1.08% of the company.

Is BYND Stock a Buy, Hold, or Sell?

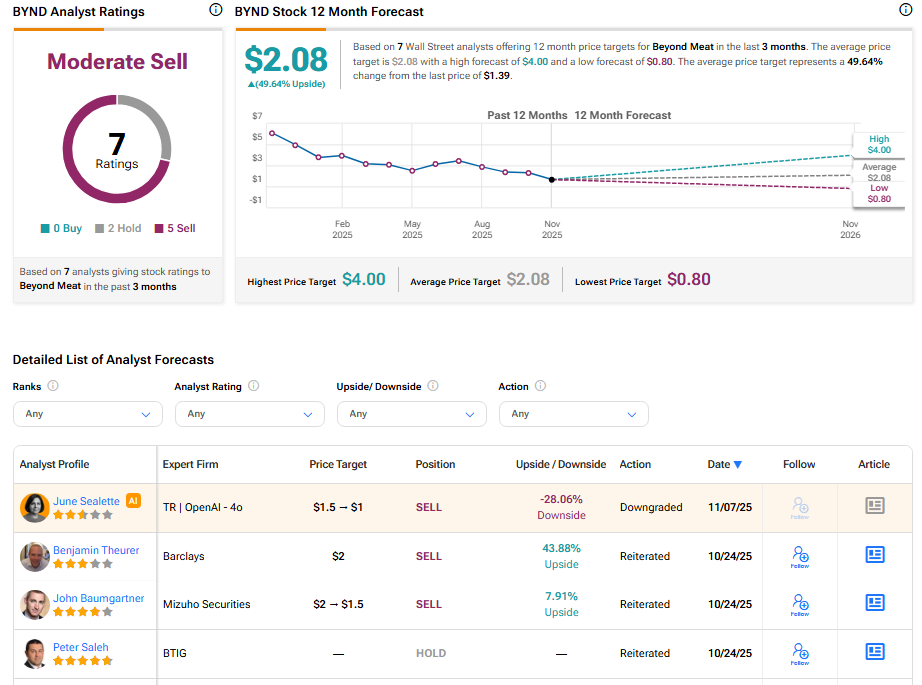

Currently, Wall Street has a Moderate Sell consensus rating on Beyond Meat stock based on five Sell and two Hold recommendations. The average BYND stock price target of $2.08 indicates about 49.64% upside potential from current levels.