When major oil-producing nations decided to implement deeper production cuts to increase oil prices, hydrocarbon energy giants like Occidental Petroleum (NYSE:OXY) were supposed to benefit. Alas, the narrative just hasn’t quite panned out. However, legendary investor Warren Buffett – the Oracle of Omaha – continues to support Occidental. Combined with compelling economic dynamics, I’m bullish on OXY stock, and I will present intriguing options-related ideas to consider.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Oracle and the U.S. Economy Supports OXY Stock

Primarily, this article will focus on the power of the derivatives market. Still, it’s worth touching on the fundamental argument to better understand the bullish opportunity. First, Buffett – through his conglomerate Berkshire Hathaway (NYSE:BRK.B) – has been executing Informative Buy transactions recently, per TipRanks insider transactions screener.

Of course, no one should invest solely in any one metric or person, even if that person is called the Oracle. However, it’s also fair to point out that Buffett has been in the game for a long time. One of the reasons he’s so respected is that he has guided his portfolio through bull and bear markets. And he continues to pick relevant ideas, which could be the case for OXY stock.

On the fundamental front, the U.S. economy is booming, printing annualized fourth-quarter GDP growth of 3.3%. This figure easily beat Wall Street’s consensus target of 2%. Additionally, the stratospheric acceleration of the January jobs report confirms that the labor market remains tight. By logical deduction, more people having more jobs equates to greater resource consumption. Since the world still runs on oil, OXY stock seems like an intriguing wager.

However, it’s also true that buying 100 shares of OXY stock would cost $5,761 at current prices – an amount not everyone readily has available. This is where a call option, which gives the holder the right but not the obligation to buy OXY at the listed strike price, comes in handy.

With each OXY stock option carrying the leverage of 100 shares of the underlying security, in exchange for the premium – the cost to acquire the option – traders with less discretionary funds can participate meaningfully in the Oracle-endorsed idea.

Still, you must avoid pitfalls because not every OXY stock option represents a good deal.

Laying the Framework for Occidental Petroleum Options

Perusing TipRanks unusual options activity tool – a screener that can be helpful in potentially identifying moves made by the smart money – one of the more intriguing opportunities centers on the OXY Jun 21 ’24 60.00 Call. Although the strike price of $60 indicates that this option is out of the money (OTM) compared to the market price of $57.61, the open interest stands at 4,698 contracts.

Conspicuously, that’s higher than the open interest for the nearly in-the-money (ITM) OXY Jun 21’ 24 57.50 Call. Therefore, the $60 call option features a very attractive bid-ask spread (on Monday, it was only 1.65%). While the figure could change, that’s practically nothing in the world of options trading. Further, the high open interest for the call suggests – though doesn’t guarantee – that the smart money is intrigued with it.

However, the $281 cost of the call ($2.81 contract price multiplied by 100 shares) may be a bit steep for some. To exchange a higher-risk profile for a lower cost, you may consider the same-expiration call but with the $62.50 strike. Here, the cost sits at a more affordable $184. Enticingly, you’re not penalized with that much of a higher spread. And that’s mainly because the open interest for the $62.50 call clocks in at a robust 5,983 contracts.

Nevertheless, with these two options expiring on June 21, you’re not getting a whole lot of time value. Instead, if you like the $57.50 call at $281, you could step up to the Aug 16 ’24 62.50 Call. In exchange for raising the strike by $5, you’re getting almost two more months of time value. Better yet, the bid-ask spread was very reasonable following Monday’s close.

Here’s why this option is so compelling. Analysts anticipate that over the next 12 months, OXY stock will reach $68.42 on average. That’s a $10.81 gap from the most recent close or a 90-cent increase per month broken down evenly.

In roughly six months, assuming a linear trend, OXY stock should gain about $5.40. Add that to the current price, and you’re basically at $63, above the $62.50 call.

Before placing a trade, though, it’s vital to remember that the options market is unlike football: you need to emphatically put the ball in the endzone. If you’re bullish on OXY stock, you need the aforementioned linear trend to break northward as acutely as possible. Otherwise, if you leave little to no time value, then you’re trading purely on intrinsic value, which could lose you money.

Valuation Incentivizes Options

If you’re just exploring the OXY stock opportunity, then the underlying valuation incentives the idea of options rather than buying the security in the open market. Specifically, the oil and gas exploration and production (upstream) component of the hydrocarbon value chain – under which Occidental falls – features an average price-earnings ratio of 7.73x. However, OXY stock prints a multiple of 12.52x.

Stated differently, a risk factor exists that investors could dump their overvalued ideas. If so, those who just hold a large volume of OXY stock directly could be in for serious pain. However, if you’re buying options, you could simply let them expire worthless. Yes, you’d still lose money, but you’d probably lose a lot less than had you incurred a hefty loss on a large equity position.

Is OXY Stock a Buy, According to Analysts?

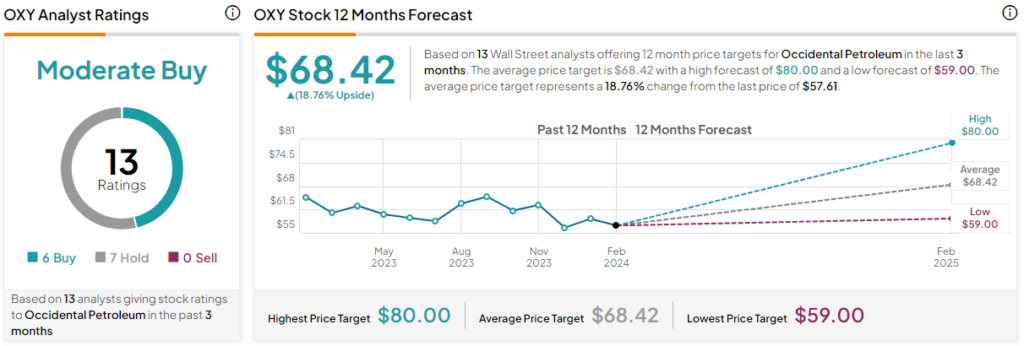

Turning to Wall Street, OXY stock has a Moderate Buy consensus rating based on six Buys, seven Holds, and zero Sell ratings. The average OXY stock price target is $68.42, implying 18.8% upside potential.

The Takeaway: OXY Stock Options Offer a Great Way to Bet with Buffett

In the energy sector, Occidental Petroleum presents an intriguing opportunity bolstered by Warren Buffett’s unwavering support. Despite recent sector challenges, Buffett’s backing and favorable economic indicators underscore the potential for OXY stock. Exploring call options provides an appealing alternative for investors seeking exposure to the Oracle-endorsed idea without committing significant capital upfront.

With careful consideration of options strategies, investors can leverage the inherent advantages of derivatives to capitalize on potential upside while managing risk effectively.