We all knew that retail was taking it on the chin. But Best Buy (NYSE:BBY) is showing us just how bad it’s getting with some big new job cuts. Normally investors like job cuts, but today, Best Buy’s chopping block could barely budge the needle as it was only up fractionally in Friday’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Best Buy did confirm the rumors but wouldn’t say just how many jobs would be on the block. “Hundreds” was the last known figure, but with a combined total of 1,042 stores in the U.S. alone as of March 13, that may not mean a noticeable loss. Further, Best Buy has over 90,000 total employees so far, though 10% of them are seasonal staffers.

However, Best Buy did offer a statement, noting that it was “evolving its stores” and was working to “…better reflect the changes in consumer shopping behavior.” Nevertheless, the employees being laid off, a report in Yahoo Finance noted, could reapply for other open positions. Severance packages would also be made available. Many of the lost jobs seem to be in branches selling products like smartphones and computers, which are generally more complex devices that often require someone on hand to ask questions.

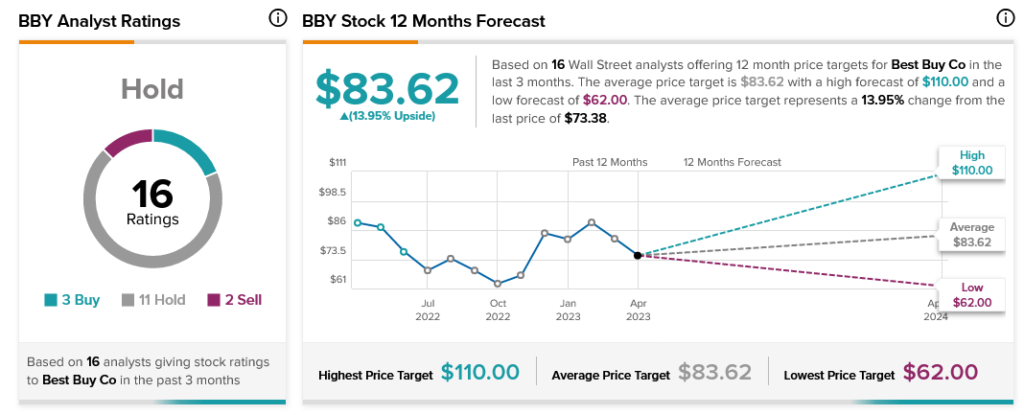

Currently, analysts have one clear opinion about Best Buy: don’t do much with it. Analyst consensus calls it a Hold, with 11 Hold recommendations stacked up against three Buys and two Sells. Furthermore, Best Buy stock comes with 13.95% upside potential thanks to its average price target of $83.62.