Best Buy (NYSE:BBY) shares are trending marginally higher today after the consumer electronics retailer posted better-than-anticipated second-quarter numbers. Although revenue declined by 7.3% year-over-year to $9.58 billion, it still outperformed estimates by $60 million. Additionally, EPS at $1.22 also came in ahead of estimates by $0.16.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, comparable sales dropped by 6.2%, with sales decreasing across the board in Best Buy’s Enterprise, Domestic, and International segments. Despite macroeconomic challenges, the company expects 2023 to be the low point in tech demand and sees the industry receiving a boost from natural upgrade and replacement cycles starting next year.

Best Buy now expects fiscal year 2024 revenue to range between $43.8 billion and $44.5 billion, compared to the prior outlook of $43.8 billion and $45.2 billion. EPS for the year is now anticipated between $6 and $6.40, as compared to the earlier range of $5.70 and $6.50.

Additionally, Best Buy has narrowed its expectations for comparable sales, now anticipating a decline between 4.5% and 6%. It previously expected comparable sales to decline in the range of 3% to 6%.

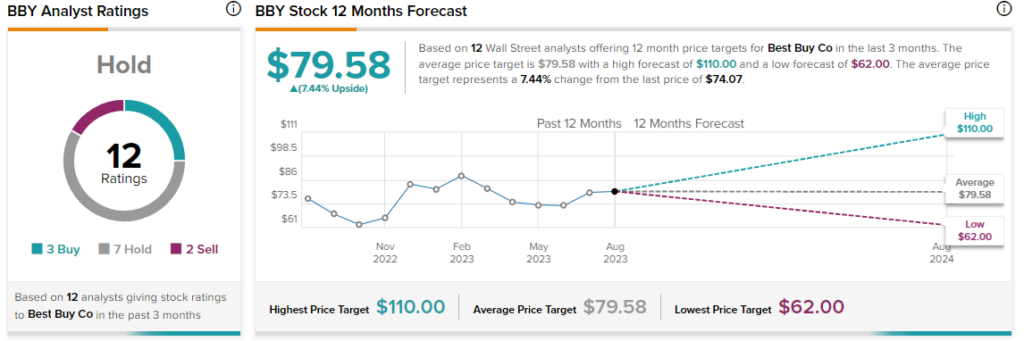

Overall, the Street has a consensus price target of $79.58 for Best Buy, alongside a Hold consensus rating.

Read full Disclosure