Big-box retailer Target (TGT) is scheduled to announce its results for the first quarter of Fiscal 2025 on May 21. Ahead of its results, Bernstein downgraded TGT stock to Sell from Hold, as it believes that the “going is getting tough for Target.” Bernstein analyst Zhihan Ma highlighted several challenges faced by the company and lowered the price target to $82 from $97. The analyst thinks that Target is finding it difficult to boost sales growth while maintaining margins, and is unlikely to achieve both these objectives.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Target stock has declined more than 25% year-to-date. Analysts expect the company’s Q1 EPS (earnings per share) to fall about 17% year over year to $1.69. Revenue is expected to remain almost flat at $24.4 billion compared to the prior-year quarter.

Bernstein Turns Bearish on TGT Stock

Ma thinks that Target’s Q1 results are likely to disappoint investors, with credit card data reflecting a dismal picture due to the impact of weak consumer sentiment, unfavorable weather, and the diversity, equity, and inclusion (DEI)-related strike in March. These adverse factors existed even before tariffs entered the picture, noted Ma. Considering the impact of tariffs, the analyst expects Target to lower its full-year guidance. He now projects FY25 EPS of $7.74, down from the previous estimate of $8.32, and FY26 EPS of $7.30 compared to the prior forecast of $8.07. Ma also lowered his FY26 comparable sales and gross margin estimates.

Aside from the near-term pressures, Ma also pointed out that Target is losing ground to digital and off-price rivals in the discretionary categories, which is weighing on its earnings power. In particular, Ma noted that TGT has lost about 50 basis points of share in apparel and 90 basis points in the home category since 2019.

The analyst further contends that while management is focused on digital channels and promotional pricing to boost traffic, he thinks that this strategy is adversely impacting margins. Ma added that while e-commerce might drive top-line growth, it is expected to weigh on Target’s profitability, given the retailer’s limited investment in automation.

Finally, Ma highlighted that TGT’s price positioning is also a matter of concern, with Berstein’s pricing monitor indicating the retailer is 11% more expensive than rival Walmart (WMT) for an identical basket of goods.

Is TGT Stock a Good Buy Now?

Heading into Q1 results, Wall Street is cautiously optimistic on Target stock, with several analysts lowering their price targets due to tariff woes, macro uncertainties, and company-specific challenges.

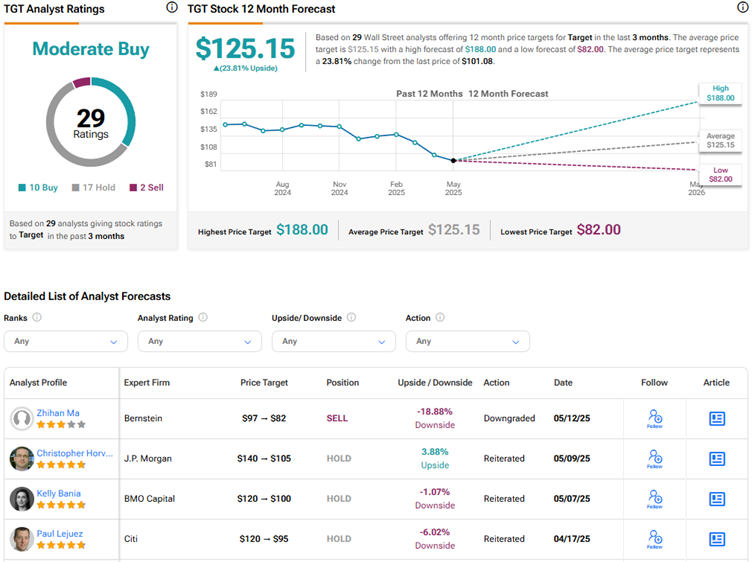

With 10 Buys, 17 Holds, and two Sell recommendations, Wall Street has a Moderate Buy consensus rating on Target stock. The average TGT stock price target of $125.15 implies about 24% upside potential.