The stock of Berkshire Hathaway (BRK.B) has received an upgrade as longtime CEO Warren Buffett prepares to step down at year’s end.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts at Edward Jones have upgraded Berkshire Hathaway’s stock to a Buy rating from Hold previously. The main reasons cited for the upgrade are Berkshire’s fortress balance sheet and its record cash pile that totals nearly $350 billion.

Analyst James Shanahan says he sees a good entry point for investors to take a position in BRK.B stock with the share price having declined noticeably since Buffett, age 95, announced in early May that he will step down as CEO at year’s end and hand the reins of Berkshire to successor Greg Abel. Since then, Berkshire’s more affordable class B stock has declined nearly 10%.

Reasonable Valuation

The share price decline has made Berkshire’s valuation more reasonable, according to Shanahan. The stock now trades at 1.5 times its projected quarter-end book value versus 1.8 times when the stock peaked on May 2 of this year, the day before Buffett announced his retirement after 60 years at the helm. Buffett will remain chair of Berkshire’s board of directors after this year.

“We believe that the current share price represents an attractive entry point for long-term investors,” wrote Shanahan in a note to clients. “In addition, Berkshire holds almost $350 billion in cash on the balance sheet, which could prove to be a strong earnings catalyst, should the company invest heavily in operating companies, individual stocks and/or Berkshire’s own shares.”

Edward Jones has added Berkshire Hathaway’s Class B stock to its Focus List in conjunction with the ratings upgrade.

Is BRK.B Stock a Buy?

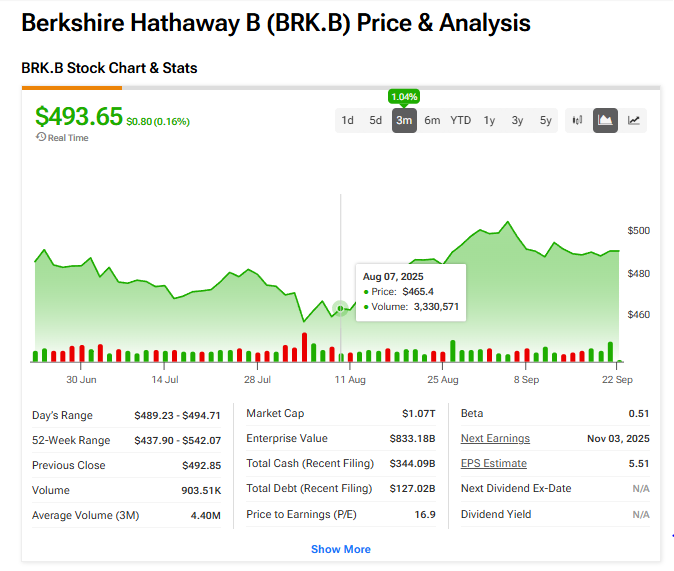

Only two analysts currently offer a rating and price target on Berkshire Hathaway’s more affordable class B stock. So instead, we’ll look at the stock’s three-month performance. As one can see in the chart below, shares of BRK.B have risen 1.04% in the last 12 weeks.