For a brief moment, it looked like China’s tech giants had found a new frontier. Ant Group and JD.com (JD) were preparing to roll out stablecoins under Hong Kong’s new licensing regime, betting that state approval in the city meant quiet consent from Beijing. This illusion ended fast.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Regulators in the capital reportedly called in executives and made the message plain. The People’s Bank of China would not tolerate any private coinage, even offshore. The tech groups hit pause almost overnight. Moreover, the intervention landed just as Hong Kong’s lawmakers were celebrating their own “digital-finance breakthrough.” It reminded everyone who sets the real limits of innovation.

Tech Ambition Collides with Monetary Sovereignty

Ant and JD.com saw stablecoins as a way to link China’s vast e-commerce networks with global capital flows. The pitch was simple. Build a yuan-backed token in Hong Kong, tap overseas demand, and stay compliant under a local license. But the central bank saw something else: a backdoor challenge to its monopoly over money creation.

Moreover, Beijing is already running its own digital-currency project, the e-CNY. A fleet of private tokens floating offshore would muddy the waters, competing with the official rollout. The result was predictable. The same government that green-lights innovation also decides when it goes too far.

Hong Kong’s Experiment Meets a Mainland Reality Check

Hong Kong has tried to position itself as a global testing ground for digital finance. Its new licensing rules promised clear oversight and investor protection, which is a stark contrast to the mainland’s cautious stance. But this gap is exactly what Beijing moved to close.

Moreover, the stablecoin setback shows that Hong Kong’s autonomy in financial innovation still depends on political coordination. The city can design the framework, but the mainland decides the scale. Several fintech insiders now say they are shifting their focus from issuing tokens to building infrastructure for tokenized assets, a safer bet in the current climate.

Regulators Play Defense Against Speculation

Chinese regulators have not forgotten the crypto chaos of 2021, when speculative coins triggered wild price swings and capital flight fears. Stablecoins, while marketed as safe, still represent private digital money that can slip beyond surveillance.

Moreover, the central bank worries that dollar-pegged tokens could undermine the renminbi’s standing in Asia. Officials have warned that once you let private actors issue money, control becomes a memory. The stablecoin freeze may look heavy-handed, but to Beijing, it is risk management in disguise.

Tech Giants Rethink Their Future in Digital Finance

For China’s fintech titans, the retreat stings. Ant and JD.com had framed their stablecoin ideas as part of a new cross-border strategy, one that would extend their payment ecosystems into global markets. Those plans are now shelved indefinitely.

Still, neither company is quitting digital assets. Executives say they will pivot toward government-aligned initiatives such as tokenized deposits and programmable payments linked to the e-CNY. Moreover, both firms understand the bigger lesson. In China, fintech can transform everything, except the hierarchy of power.

Beijing Balances Innovation with Authority

The stablecoin pause underscores a defining tension in China’s economy. The state wants to lead in digital finance, yet it fears losing grip on monetary order. The compromise is control disguised as progress. Innovation happens, but only on the government’s timeline.

Moreover, Beijing’s stance carries global weight. While the United States debates stablecoin regulation and Europe experiments with tokenized euros, China is taking a different route, one that keeps private finance on a leash. The message to its own tech giants is unmistakable. The digital-currency future may be open, but the gatekeeper remains the same.

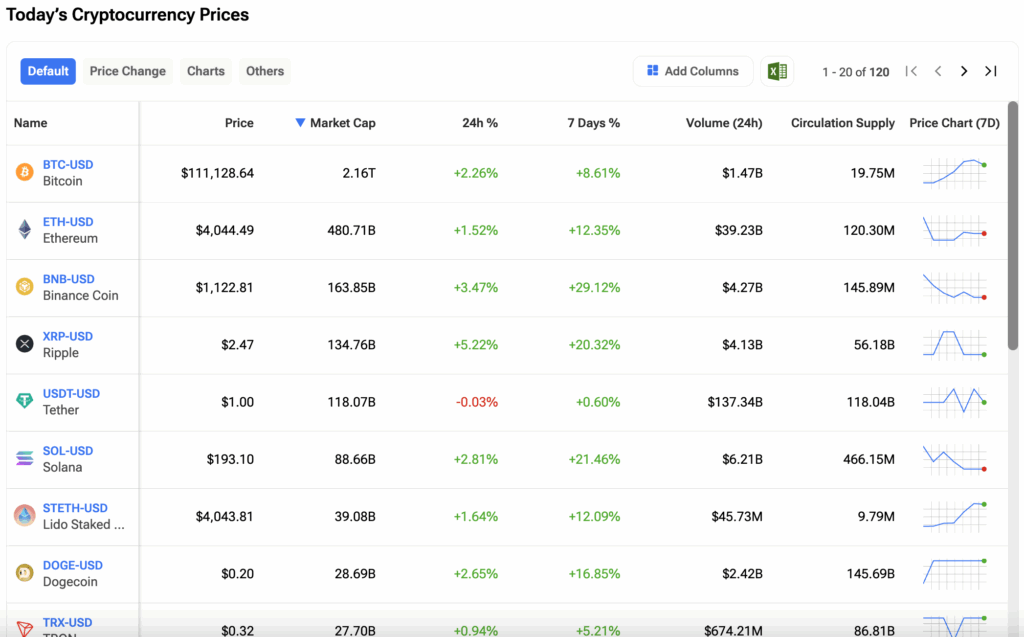

Investors can track the prices of their favorite cryptocurrencies on the TipRanks Cryptocurrency Center. Click on the image below to find out more.