Artificial intelligence is reshaping industries and fueling a fierce race among tech companies, keeping AI stocks firmly in the spotlight. Among the sector’s most talked-about names, BigBear.ai (BBAI) and C3.ai (AI) stand out for their rapid growth ambitions and sharp price swings. So which AI player is a safer bet for investors in the long term? Here’s a closer look at their businesses, recent performances, and potential risks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BigBear.ai operates in a more niche arena, with heavy exposure to government contracts and mission-critical work for the defense and intelligence sectors. C3.ai, by contrast, serves a broader market, offering AI solutions across industries such as energy, manufacturing, finance, and healthcare, and maintains a diverse mix of private and public clients.

Is BigBear.ai a Good Stock to Buy?

BigBear.ai shares have experienced a sharp rally, climbing more than 300% over the past year and rising 57% so far in 2025. However, the company’s recent financial performance has lagged analyst expectations. In Q2, BigBear.ai reported revenue of $32.5 million, falling short of the $40.59 million consensus estimate, primarily due to lower volume on certain U.S. Army programs. Meanwhile, the company posted an adjusted loss of $0.71 per share, missing the expected $0.06 loss.

Despite near-term challenges, CEO Kevin McAleenan highlighted that BigBear.ai is approaching a pivotal moment, supported by the “One Big Beautiful Bill,” which allocates $170 billion to Homeland Security and $150 billion to defense technology. Both these key areas are aligned with BigBear.ai’s expertise in national and border security. However, heavy dependence on federal contracts comes with risks, as changes in government priorities or budgets could affect future agreements.

Is C3.ai a Good Stock to Buy?

In contrast to BigBear.ai, C3.ai shares have fallen nearly 50% year-to-date. Like BigBear.ai, C3.ai also posted disappointing results for Q1 FY26. C3.ai reported revenue of $70.3 million, marking a 19.3% decline from the prior year and well below the Street’s $93.8 million estimate. The company also recorded a net loss of $0.37 per share, wider than the expected $0.21 loss. Adding to investor uncertainty, the company has withdrawn its full-year guidance due to leadership changes and organizational restructuring.

On the plus side, C3.ai appointed Stephen Ehikian as CEO on September 1 to steer the company forward. Ehikian is expected to boost C3.ai’s growth and expand its presence in enterprise AI.

In terms of government budget cuts, C3.ai is less exposed, with government contracts making up only 26% of its 2025 bookings. In contrast, BigBear.ai could be hit hard, as most of its revenue depends on federal contracts.

AI or BBAI: Which Stock Offers Higher Upside, According to Analysts?

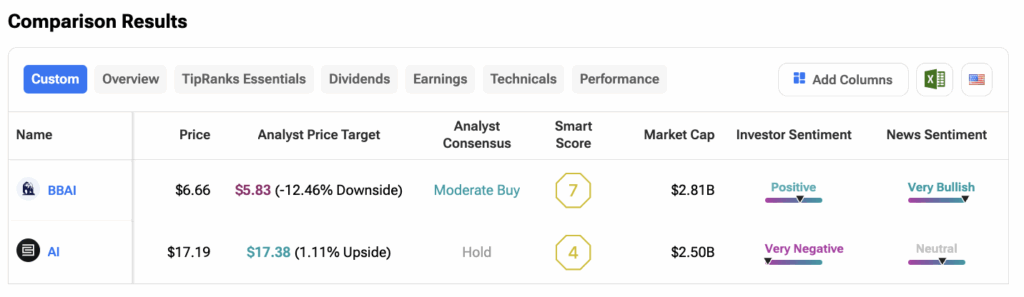

Using TipRanks’ Stock Comparison Tool, we compared C3.ai and BigBear.ai to see which AI stock analysts favor.

BigBear.ai carries a Moderate Buy rating, while C3.ai is rated Hold. However, BBAI’s price target of $5.83 suggests a potential downside of about 12% after its recent surge, whereas C3.ai’s stock price target of $17.38 is close to its current trading level, implying minimal upside of just 1%.

Conclusion

Investors seeking exposure to AI with a focus on government contracts might consider BigBear.ai, acknowledging the higher risk associated with its niche market and recent financial performance. Conversely, those preferring a more diversified approach with a broader market presence may find C3.ai appealing.

In conclusion, BigBear.ai offers higher risk and reward, benefiting from government-focused contracts but vulnerable to budget shifts and execution risks. C3.ai, by contrast, is more diversified across industries, with less exposure to federal spending, making it a lower-risk option for investors.