Shares of BlackBerry (NYSE:BB) gained in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at $0.06, which beat analysts’ consensus estimate of -$0.06 per share. Sales increased by a whopping 122% year-over-year, with revenue hitting $373 million. This beat analysts’ expectations by more than $213 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The firm reported a 48% gross margin in both GAAP and non-GAAP terms, negatively influenced by the finalization of a significant non-core patent portfolio sale. Had it not been for this transaction, the non-GAAP gross margin would have been boosted by an extra 22 percentage points. The IoT division made a robust $45 million, flaunting a striking 80% gross margin. The cybersecurity segment, on the other hand, scored $93 million, complemented by a 60% gross margin and an ARR of $289 million. This division witnessed its billings surge to $122 million, marking a consistent quarterly rise and a 37% annual growth.

In terms of licensing and other revenues, we’re talking about $235 million, with the lion’s share ($218 million) being a direct result of the patent sale. While the firm achieved a $35 million non-GAAP operating profit, it suffered an $11 million GAAP operating loss.

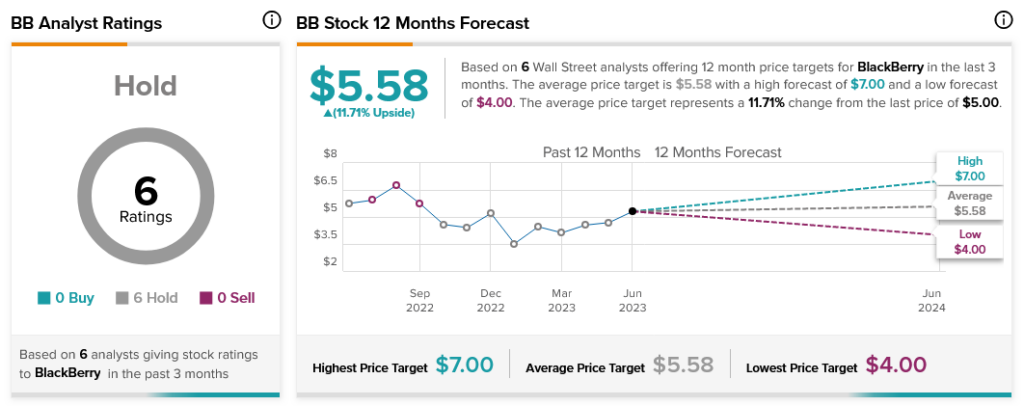

Overall, Wall Street has a consensus price target of $5.58 on BlackBerry, implying 11.71% upside potential, as indicated by the graphic above.