Bausch Health (NYSE:BHC) saw its shares fall by nearly 7% after suing Amneal Pharmaceuticals (NASDAQ:AMRX) over a generic version of its intestinal disease medication, Xifaxan. Analyst Michael Nedelcovych from TD Cowen, who has a neutral outlook with a $12 target on Bausch Health, suggests this move might trigger a prolonged period of legal issues. He also emphasized that Xifaxan is crucial for Bausch Health’s financial future.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This lawsuit comes as Bausch awaits a verdict in another case against Norwich Pharmaceuticals, which again centers around another generic version of Xifaxan. Nedelcovych warns that the Amneal case highlights the continuous threat of generic competitors to Xifaxan’s market dominance, making the drug’s future uncertain.

Is BHC a Good Buy?

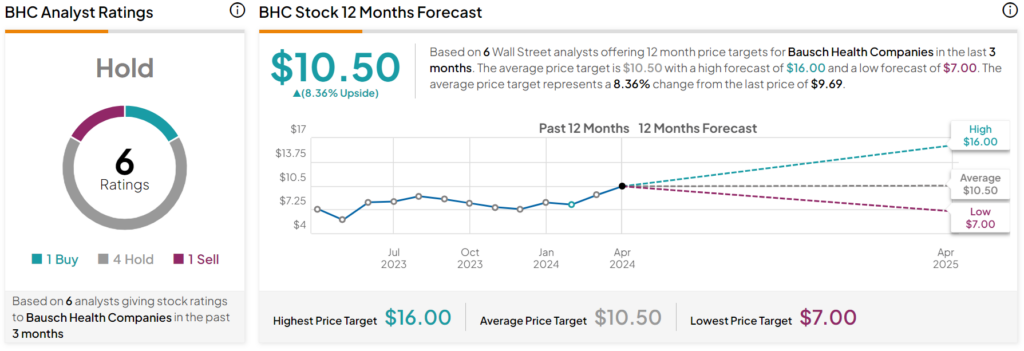

Overall, analysts have a Hold consensus rating on BHC stock based on one Buy, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 29% rally in its share price over the past year, the average BHC price target of $10.50 per share implies 8.36% upside potential.