Great news for those with ulcerative colitis; you’ll likely soon have a new treatment option. Healthcare stock Bausch Health Companies (TSE:BHC) (NYSE:BHC) revealed that its latest treatment concluded Phase 2 testing, and the news is looking good. So, too, is Bausch’s stock price, which is up in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Topline results for Amiselimod, Bausch’s new ulcerative colitis treatment, came out positive, with 32.4% of patients reaching “clinical remission.” That’s nearly double the 17.8% that managed to do the job with a placebo. Meanwhile, those patients who merely showed “endoscopic improvement” came out even better, with 42.7% of patients reaching that level. Again, that’s nearly double the 23.4% that did the job with a placebo. The next step is, not surprisingly, Phase 3 testing and Bausch is already meeting with regulators to define the tests and get ready for what will likely be the last move before commercialization can start up.

Just the Right Time for a Win

This was a win Bausch needed, and sorely. Bausch’s share price has been in freefall over the past five years, trading around its lowest levels for the last 10 years. Back in 2015, shares sold for just over C$335 per share. And with multiple lawsuits emerging over everything from Xifafan to contract issues with drug makers, news of a drug that’s likely to get commercialized and turn into a new revenue stream certainly can’t hurt. Especially considering there’s a growing push toward getting Xifafan converted into a generic, which would lose Bausch a lot of market share in the irritable bowel syndrome (IBS) market.

What is Bausch’s Target Price?

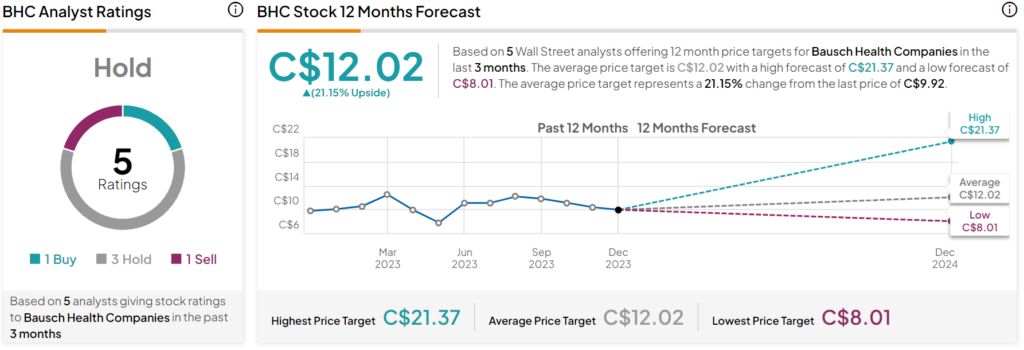

Turning to Wall Street, analysts have a Hold consensus rating on BHC stock based on one Buy, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 9.2% rally in its share price over the past year, the average BHC price target of C$12.02 per share implies 21.15% upside potential.