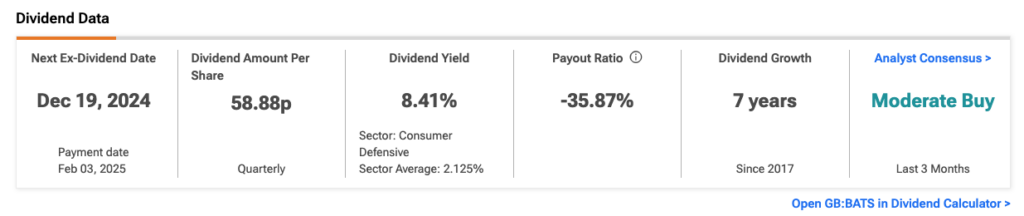

UK-based British American Tobacco PLC (GB:BATS) offers a dividend yield of over 8%, making it an attractive option on the FTSE 100 index for passive-income investors. Additionally, the company’s dividend yield exceeds the industry average of 2.125%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BAT is a global corporation specializing in the production and sale of cigarettes, tobacco, and nicotine products, with a portfolio of popular brands like Dunhill, Camel, and Newport. Despite the decline in the traditional smoking market, BAT remains a dominant player, showing promising growth in its non-combustible product categories.

BATS Adopts Progressive Dividend Growth Policy

The company adopts a progressive dividend policy to consistently reward its shareholders. It pays dividends in four equal quarterly instalments in May, August, November, and February.

In 2024, BAT paid two instalments of 58.88p per share, with a third payment of the same amount scheduled for February 2025. This marks an increase of around 2% on last year’s quarterly payment of 57.72p per share.

Looking ahead, the company is dedicated to maintaining its dividend policy and expects to generate £40 billion in free cash flow before dividends over the next five years.

BAT on Track with Its Share Buyback Program

In other news, the company today announced that it has purchased 89,170 ordinary shares as part of its ongoing share buyback program. BAT aims to buy back £1.60 billion worth of ordinary shares, allocating £700 million in 2024 and the remaining £900 million in 2025.

The company will cancel these shares, decreasing the total number of shares outstanding and potentially enhancing the value of the remaining shares.

Are BATS Shares a Good Buy?

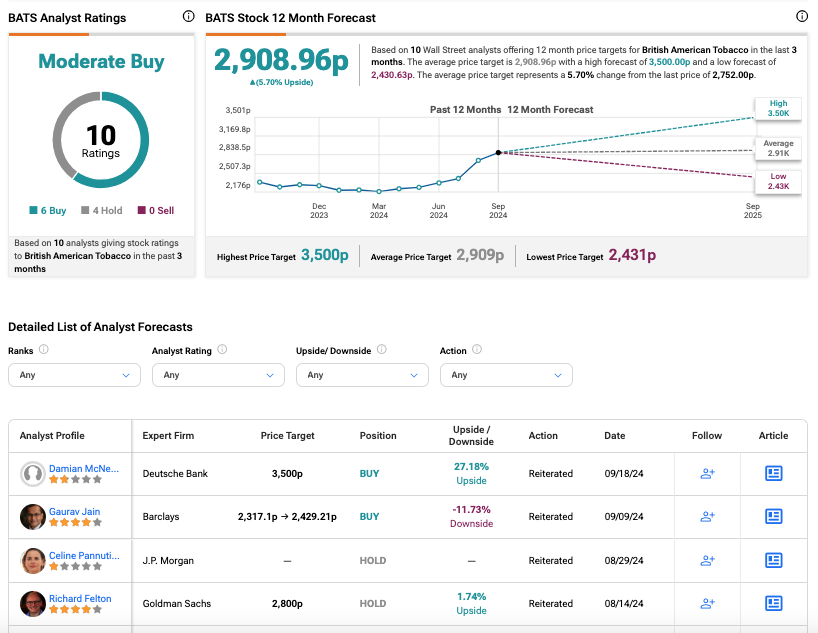

According to TipRanks, BATS stock has a Moderate Buy consensus rating based on six Buys and four Holds assigned in the last three months. At 2,908.96p, the average BATS share price target implies a change of 5.7% on the current price level.