Top-rated analyst Tim Long stated that Barclays’ Apple (NASDAQ:AAPL) Supplier Tracker indicated lower February hardware builds for the tech giant compared to January. However, the analyst noted that the company’s App Store growth rose by 15% year-over-year in February, averaging 10% for the quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Long commented that Barclays’ checks continued to show weak iPhone builds, with sales impacted by market dynamics and competition, particularly in China. The analyst noted that the rising competition from Chinese players like Huawei has resulted in iPhone sales plummeting 24% year-over-year. While the analyst acknowledged that iPhone sales are stronger in emerging markets, they are still not strong enough to offset this weakness.

The analyst finds that the recent enforcement of the EU’s Digital Markets Act and the ongoing U.S. Department of Justice versus Google (NASDAQ:GOOGL) (NASDAQ:GOOG) trial could pose risks for the stock. Long also does not see any “significant design changes” for the iPhone 16, expected after 2025.

The analyst continues to foresee weak demand for the iPhone 15 and remains bearish on AAPL with a Sell rating and a $158 price target. Long’s price target implies a downside potential of 7.5% at current levels.

Is Apple a Good Buy Now?

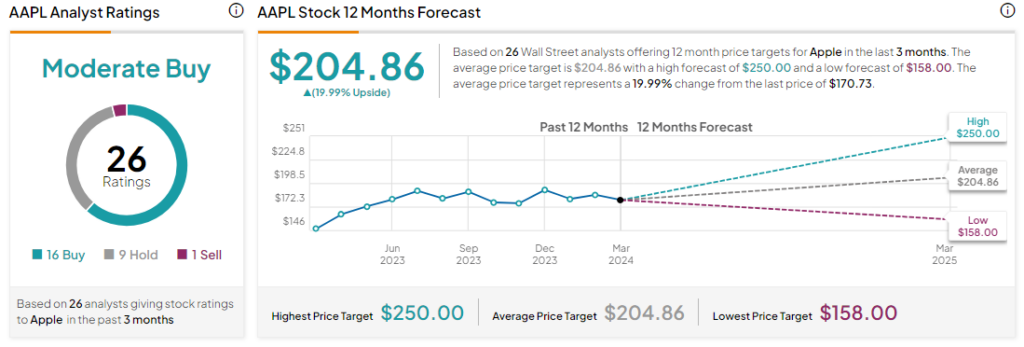

Overall, analysts remain cautiously optimistic about AAPL with a Moderate Buy consensus rating based on 16 Buys, nine Holds, and one Sell. Over the past year, AAPL stock has gone up by more than 10%, and the average AAPL stock price target of $204.86 implies an upside potential of around 20% at current levels.