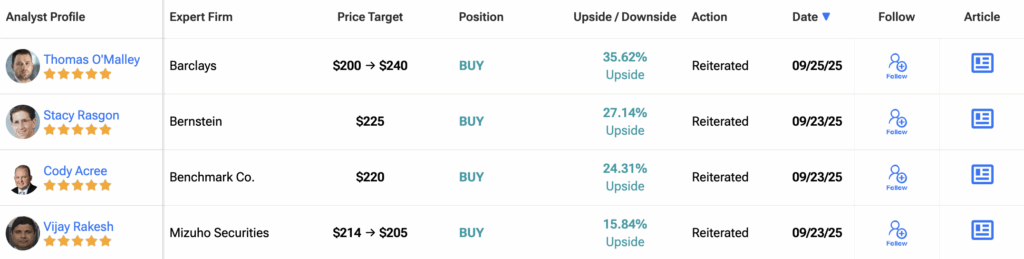

Barclays (BCS) analyst Tom O’Malley called Nvidia stock (NVDA) ‘the most attractive name in our space.’ He also raised his target price on NVDA stock to $240 from $200, which implies a 36 percent rally from current levels. He wrote that more than $2 trillion in announced AI infrastructure spending will eventually filter into the company’s results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

O’Malley estimates that about $1.5 trillion of that capital will go directly toward compute and networking power, where Nvidia dominates with its graphics-processing units. The buildout could require as many as 19 million GPUs, and he argued that most of that demand will flow to Nvidia over the next five years.

“We see this [AI spending] largely flowing into the Nvidia P&L [profit-and-loss] over the next 5+ years, moving numbers materially higher and making this the most attractive name in our space,” O’Malley wrote.

Valuation Shift Reflects AI Momentum

The analyst boosted his valuation framework as well. O’Malley now applies a 35-times price-to-earnings multiple to his 2026 earnings forecast, up from a 29-times multiple previously. He justified the increase by pointing to upside from continued data center construction and accelerating AI momentum.

At a share price of $176 and 38 cents in pre-market trading on Thursday, Nvidia has been flat over the past month despite widespread announcements of AI investment. O’Malley believes the stock is lagging the scale of the opportunity ahead.

What This Means for Investors

For investors, the takeaway is straightforward. Nvidia is already the market leader in AI chips, and analysts expect demand to grow much faster than current valuations suggest. While the stock has cooled in recent weeks, the long-term story remains tied to capital spending by cloud giants and enterprises building AI infrastructure.

If even a portion of the projected $2 trillion in spending materializes, Nvidia’s earnings base will expand significantly. This could provide both growth in profits and justification for a higher trading multiple, the two ingredients needed for sustained stock gains.

Rivals Also Face Pressure

Other chip makers were weaker in early trading as well. Shares of Advanced Micro Devices ($AMD fell 0.7%, while Broadcom (AVGO) edged down 0.2%. The competitive landscape remains intense, but analysts at Barclays suggest Nvidia’s leadership in compute GPUs gives it the most leverage to AI spending among its peers.

Is Nvidia a Good Stock to Buy?

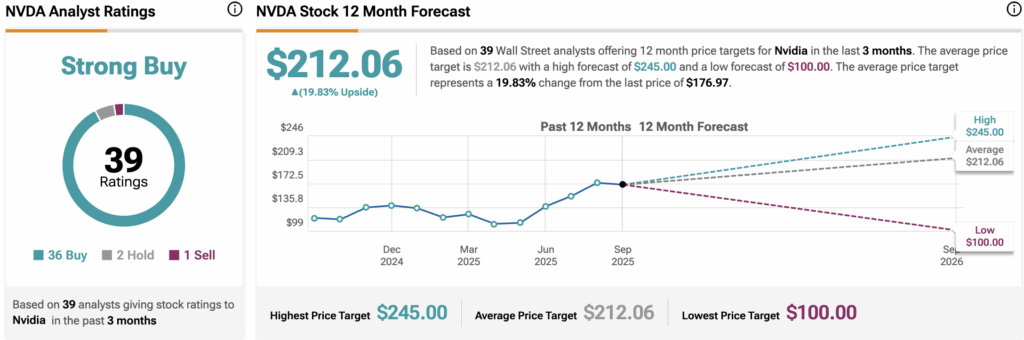

Turning to TipRanks, Nvidia carries a Strong Buy consensus from 39 analysts who have issued ratings over the past three months. Out of the group, 36 rate the stock a Buy, two rate it a Hold, and just one analyst recommends a Sell.

The average 12-month NVDA price target now sits at $212.06, which implies nearly 20 percent upside from the current share price.