While Hollywood has been battered this year with actors’ and writers’ strikes, it has been a refreshing summer for the movies at the box office in summer blockbusters, where established franchises have long been the reigning champions. The year 2023 has brought a refreshing twist. This year, the spotlight shifted to two unexpected newcomers, Barbie and Oppenheimer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Warner Bros. Pictures’ (WBD) Barbie dazzled with $609.5 million in domestic ticket sales so far and has earned a staggering $1.4 billion globally. Universal’s (CMCSA) Oppenheimer followed suit, grossing $308.6 million domestically and $851.3 million worldwide. The success of these movies has been remarkable as they have outperformed even beloved franchises like Indiana Jones and the Dial of Destiny (DIS) and Mission: Impossible: Dead Reckoning (PARA).

WBD stock is up 21.2% year-to-date, while CMCSA stock has risen 30.5% year-to-date. Both stocks are Moderate Buys, according to analyst consensus sentiment.

Shift in Movie Industry

According to Comscore data, summer box office revenues could surge by 19% year-over-year through the Labor Day weekend, totaling an estimated $4.1 billion, thanks to Barbie, Oppenheimer, and other surprises like Sound of Freedom. This shift challenges the industry’s reliance on established franchises, signaling a growing demand for fresh narratives.

Even Disney’s CEO Bob Iger had stated following the disappointing box-office performance of its Star Wars film Solo that the media giant is rethinking its “aggressive” release strategy for its Star Wars movies.

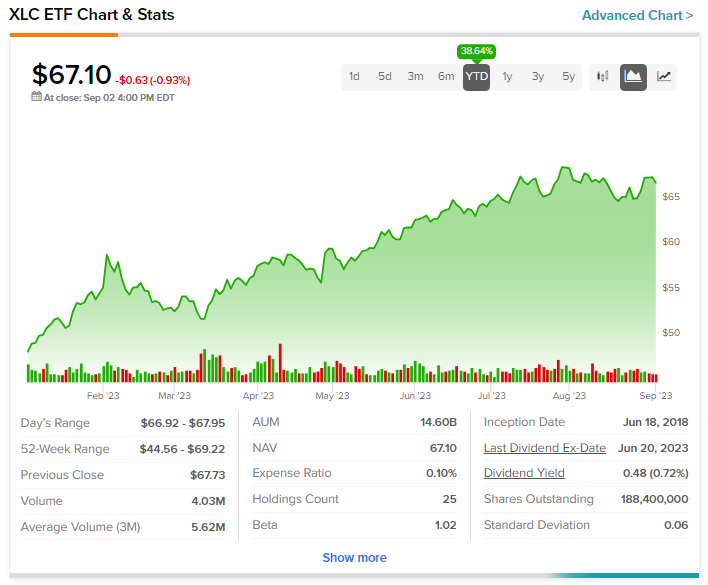

XLC Stock – Communications ETF

For investors interested in the media sector, the Communication Services Select Sector SPDR Fund (XLC) is a good option that has surged by more than 35% year-to-date.