Bankrupt cryptocurrency firm FTX got a nod from a judge in the U.S. Bankruptcy Court for the District of Delaware to sell, stake, and hedge its crypto holdings. FTX had filed for approval to sell its idle holdings to pay back its creditors. The firm has $3.4 billion in digital assets, including $1.16 billion in Solana (SOL-USD), $560 million in Bitcoin (BTC-USD), and $192 million in Ethereum (ETH-USD).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Judge John Dorsey, who approved the motion, also overruled two motions that objected to the plan. Notably, lawyers representing the firm’s secured and unsecured creditors supported the plan. On the other hand, two FTX customers raised concerns that selling crypto assets could lead to a fall in crypto prices. They argued that the news of FTX’s asset sale could result in a short-selling mechanism and a downward spiral in crypto prices.

However, the judge maintained that FTX can sell only up to $100 million in cryptocurrency per week. Plus, it can enter into hedging and staking agreements for the digital assets to minimize the asset price volatility risk. The judge also ruled that FTX could increase its weekly selling target to $200 million if both sets of creditors approved it.

FTX has roped in the services of U.S.-based crypto firm Galaxy to act as an investment advisor in the asset sale process and risk management services. The failure of FTX last year led to a domino effect, taking down several other crypto firms and severely impacting crypto prices.

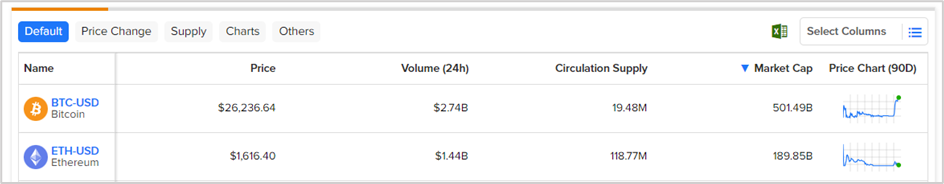

Bitcoin and Ether, two of the largest cryptocurrencies, have gained well in 2023 but are still trading far from their all-time highs touched on November 10, 2021. Currently, BTC-USD is trading at a 61.9% discount to its all-time high of $68,978.64. Similarly, ETH-USD is trading at a 66.7% discount to its all-time high of $4,865.94.