Treasury Secretary Janet Yellen said something recently that most people—including a lot of bank stocks—likely did not see coming. She suggested that more banks engage in mergers. After watching the weeks-long debacle with Microsoft (NASDAQ:MSFT) and Activision (NASDAQ:ATVI), among several others, you’d think that calling for more mergers would be last on the list as far as government plans go. But that’s just what happened, and bank stocks took it on the chin as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

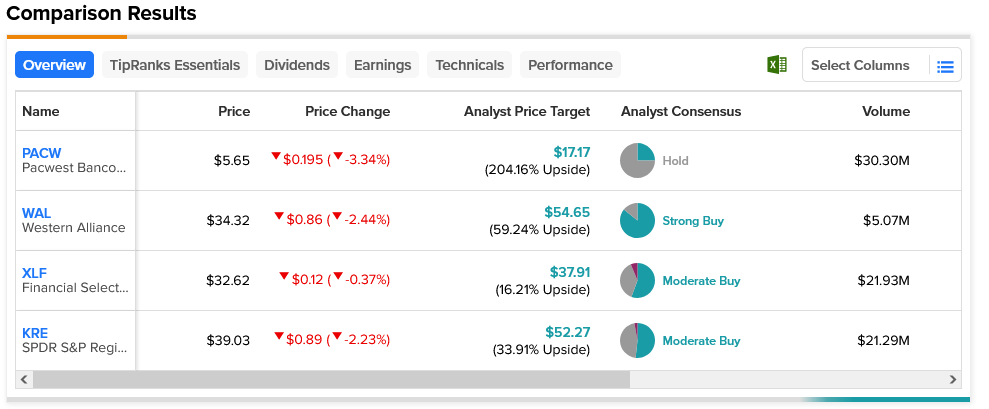

From ETFs like the Financial Select SPDR Fund ETF (NYSEARCA:XLF) and the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) to regional bank stocks like PacWest Bancorp (NASDAQ:PACW) and Western Alliance (NYSE:WAL), the whole sector took a hit.

What actually caused the hit in question was Yellen noting that more banks may need to get together via mergers and acquisitions in order to survive going forward. After all, a potential debt default for the United States may still happen. It’s also worth noting that the banking sector has seen its share of recovery in recent days as depositors are starting to come back to the fold. Nonetheless, Yellen emphasized that consolidation may ultimately prove necessary to keep the banking system viable long-term.

The bank that took the hardest hit, PacWest, which lost 3.34% in Friday’s trading, also represents the best potential buy in the fold. Though it’s only rated a Hold by analyst consensus, its $17.17 average price target gives it an upside potential of 204.16%. Meanwhile, the Financial Select SPDR Fund ETF only lost 0.37% in Friday’s trading, and is considered a Moderate Buy by analysts. However, its average price target of $37.91 gives it just 16.21% upside potential.