Kicking off earnings, bank giants JPMorgan Chase & Co. (NYSE:JPM), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), and Citigroup (NYSE:C) reported their Q4 financials on Friday. (Learn more about their Q4 performance here.) Next up are Morgan Stanley (NYSE:MS) and Goldman Sachs (NYSE:GS), slated to announce their Q4 earnings today, January 17. While higher interest rates will likely boost income from loans, lower investment banking fees could remain a drag. Also, provisions are expected to rise due to the weak macro backdrop. Let’s dig deeper.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Is Morgan Stanley Stock a Buy Now?

Morgan Stanley stock was recently double-downgraded to Sell from Buy by Wolfe Research analyst Steven Chubak. The analyst expects Morgan Stanley’s NII (Net Interest Income) to peak in Q4 or at the beginning of 2023, which will pressure operating margins.

Also, Chubak highlighted Morgan Stanley’s high valuation as a concern. Notably, Morgan Stanley is trading at a Price/Book Value multiple of 1.68, more than 31% higher than the sector median of 1.28.

Nevertheless, Morgan Stanley stock has a Moderate Buy consensus rating on TipRanks based on seven Buy, five Hold, and one Sell recommendations. Meanwhile, analysts’ average price target of $96.60 implies 5.47% upside potential.

As for Q4, analysts expect Morgan Stanley to post earnings of $1.25 per share in Q4, down about 40% year-over-year. Lower levels of completed M&A transactions will likely hurt Morgan Stanley’s Q4 revenues and bottom line. Moreover, an increase in provisions due to the challenging macro environment will hurt its bottom line.

What’s the Prediction for Goldman Sachs Stock?

Beginning in Q4, Goldman Sachs will operate through three business segments: Global Banking & Markets, Platform Solutions, and Asset & Wealth Management.

While organizational changes are expected to strengthen its core business and accelerate growth, near-term challenges from lower activities in the M&A segment and muted debt issuance could hurt its Q4 financials.

Furthermore, Goldman Sachs provision for credit losses could increase, reflecting the growth in the consumer lending portfolio and the weak macro environment. Notably, Morgan Stanley analyst Betsy Graseck lowered the price target on Goldman Sachs stock to $356 from $384 ahead of Q4 earnings, citing pressure on the bottom line from higher provisions.

Wall Street expects Goldman to report earnings of $5.56 per share, significantly lower than the $10.81 per share in the prior-year quarter.

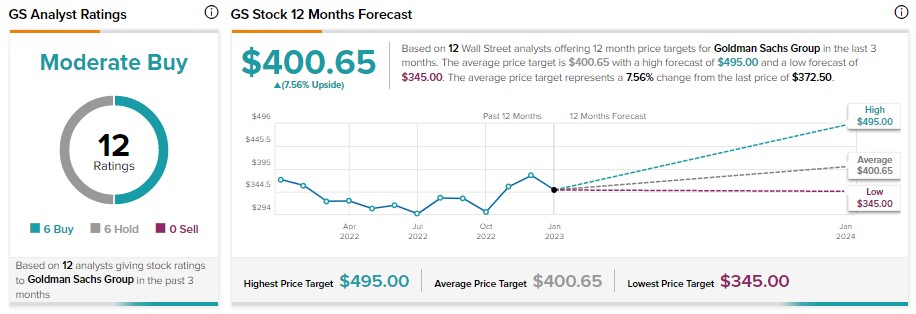

Goldman Sachs stock has received six Buy and six Hold recommendations for a Moderate Buy consensus rating. Meanwhile, analysts’ price target of $400.65 implies 7.56% upside potential.

Bottom Line

Higher interest rates are expected to give a boost to loan-led income. However, the decline in deal activities in the M&A segment and higher provision for credit losses due to a weak macro environment will likely hurt the profitability of Morgan Stanley and Goldman Sachs in Q4.