Canadian bank stock Bank of Nova Scotia (TSE:BNS) (NYSE:BNS) took a step forward today in multiculturalism and opportunity by announcing plans to build the first indigenous-owned investment dealer in Canada. Once completed, the move will draw more indigenous people into the Canadian equities market and potentially create some new opportunities therein. The move calls for two indigenous development companies and one First Nation company to join in with Scotiabank.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Everybody but Scotia will put up 23.3% of the costs and come away with that same amount of the stake. The remaining 30.1%, meanwhile, will be in Scotia’s hands, giving it a slim majority over any single other shareholder but leaving it largely subject to any coalition effort therein.

A Good Time for It

Some might consider a move like this little more than raw pandering, a bit of multicultural opportunism. But no matter if you look at it cynically or aspirationally, it’s still a good move. After all, 53% of the company is currently owned by institutional investors, who also control the company for the most part. Given the particularly sensitive environment about various cultures these days, being visibly seen to help at least one of them likely won’t hurt Scotiabank’s image going forward.

Is the Bank of Nova Scotia a Good Investment?

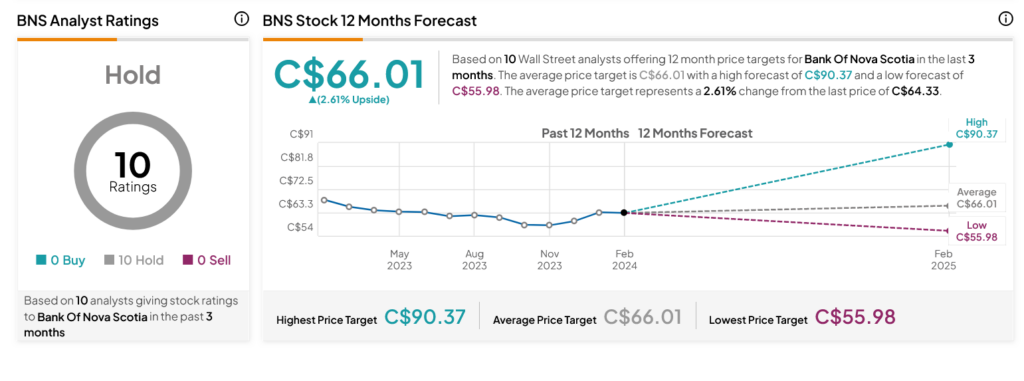

Turning to Wall Street, analysts have a Hold consensus rating on BNS stock based on 10 Holds assigned in the past three months, as indicated by the graphic below. After a 3.57% loss in its share price over the past year, the average BNS price target of C$66.01 per share implies 2.61% upside potential.