Shares of Canadian bank Bank of Nova Scotia (TSE:BNS) (NYSE:BNS) gained in today’s trading as investors await its Q2 earnings results on May 28 before the market opens. Analysts are expecting earnings per share to come in at C$1.56 on revenue of C$8.326 billion. This represents a decline from the C$1.70 per share seen in the year-ago period, according to TipRanks’ data.

BNS has not enjoyed a good track record lately when it comes to beating estimates. Indeed, the bank only beat EPS forecasts three times during the past eight quarters, as demonstrated in the image below.

Options Traders Anticipate a Relatively Large Move

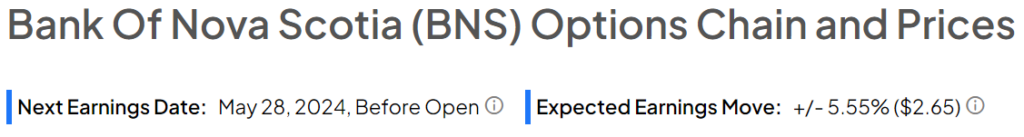

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a relatively large 5.55% move in either direction.

Is Bank of Nova Scotia a Buy Now?

Turning to Wall Street, analysts have a Hold consensus rating on BNS stock based on eight Holds assigned in the past three months, as indicated by the graphic below. After a 4% increase in its share price over the past year, the average BNS price target of C$67.38 per share implies 3.23% upside potential.

Is BNS the Right Stock to Buy for Passive Income?

Before you hurry to invest in BNS, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and BNS is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

Get a FREE sample of dividend stock ideas! ➜