Bank of America (BAC) has unveiled a series of new growth targets at its Investor Day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The second-largest lender in the U.S. outlined new medium-term financial targets that include deposit growth of 4% or higher, loan growth of 5%, and net interest income growth of 5% to 7% at a compound annual growth rate (CAGR).

Senior management at Bank of America also set an earnings-per-share growth target of 12% or more, along with a return on tangible common equity (ROTCE) goal of 15%, rising to between 16% and 18% in the medium term.

Not Impressed

While Bank of America executives did their best to trumpet the new growth targets, they seem to have left investors underwhelmed, judging by the 3% decline in BAC stock on Nov. 5, the day of the Investor Day event.

Analysts point out that the new targets represent only a modest increase from Bank of America’s previous shareholder model that ran from 2015 to 2024, which targeted 10% to 12% earnings growth and 12% to 15% return on tangible common equity.

The new goals are also based on assumptions for modest U.S. economic and inflation growth, including no recession. Some analysts warned those assumptions might not be realistic. This was Bank of America’s first Investor Day in 14 years.

Is BAC Stock a Buy?

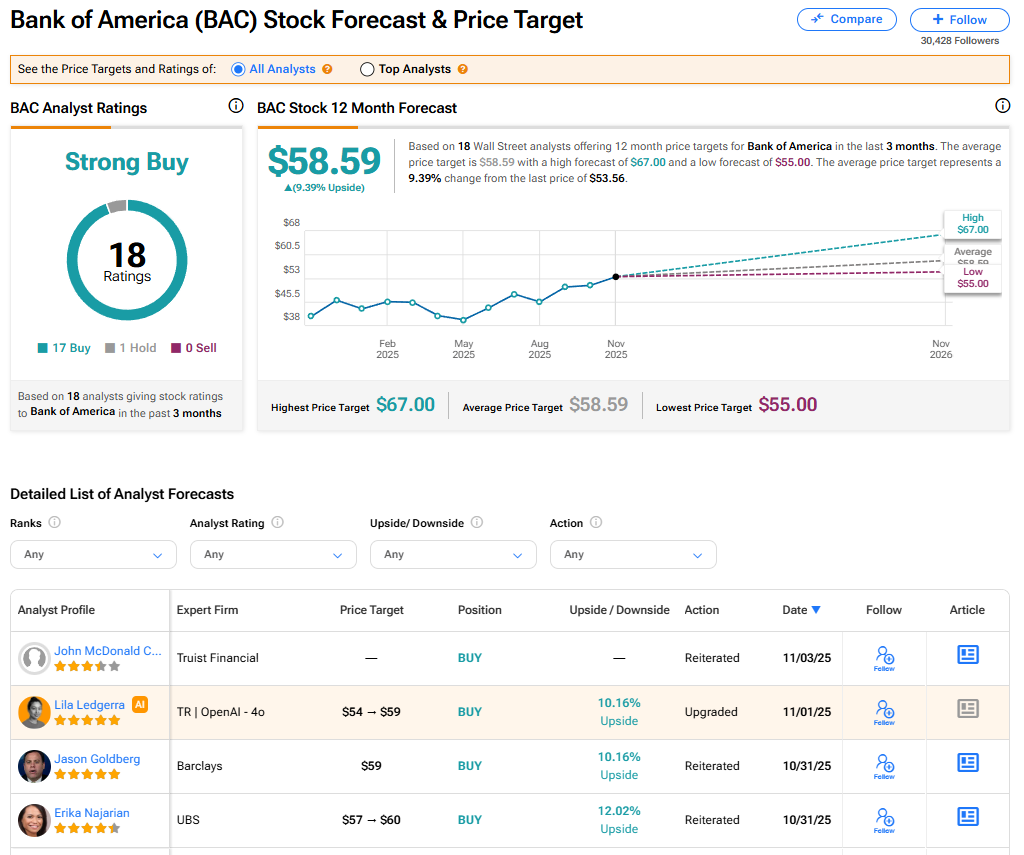

The stock of Bank of America has a consensus Strong Buy rating among 18 Wall Street analysts. That rating is based on 17 Buy and one Hold recommendations issued in the last three months. The average BAC price target of $58.59 implies 9.39% upside from current levels.