Bank of America (NYSE: BAC) posted Q3 revenues of $24.5 billion, up 8% year-over-year, surpassing analysts’ estimates of $23.5 billion. The growth in revenues was driven by “increased client activity.” The bank’s earnings came in at $0.81 per share, coming in ahead of $0.78 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Bank reported a common equity tier 1 (CET1) ratio of 11% in Q3, up by 49 basis points from the second quarter.

Bank of America’s Chair and CEO Brian Moynihan commented, “Our U.S. consumer clients remained resilient with strong, although slower growing, spending levels and still maintained elevated deposit amounts. Across the bank, we grew loans by 12% over the last year as we delivered the financial resources to support our clients.”

Is BAC a Buy or Sell?

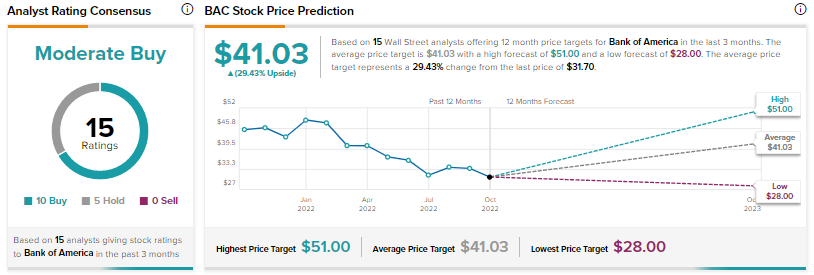

Wall Street analysts are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 10 Buys and five Holds.

The average price target for BAC stock is $41.03, implying an upside potential of 29.4% at current levels.