Bank of America Securities analyst Allen Lutz remains bearish on Hims & Hers Health (HIMS) stock and stated that the possibility of the telehealth platform delivering a Q3 beat is “less likely.” Lutz reiterated a Sell rating on HIMS stock with a price target of $28. Despite concerns about regulatory woes and the fallout with Novo Nordisk (NVO) due to allegations related to the compounded semaglutide business, HIMS stock has rallied more than 130% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The surge in HIMS stock price, despite ongoing challenges, reflects strong revenue growth and optimism about the company’s long-term growth prospects beyond GLP-1 drugs.

Bank of America Analyst Reaffirms a Sell Rating on HIMS Stock

Lutz had earlier seen the potential for HIMS to beat Q3 estimates based on observed sales data trends through August. However, the 4-star analyst noted that September sales trends through the first three weeks of the month indicate that this could be less likely.

Bank of America’s online revenue estimates for Q3, based on data through August, pointed to a range of $565 million to $596 million, with the midpoint ahead of the Street’s consensus estimate of $571 million. This forecast assumed about 30% year-over-year growth in gross observed sales in September. That said, trends through the first three weeks indicate that September sales growth is tracking toward low-to-mid 20s, implying that Q3 online revenue is “tracking closer to in-line or a slight miss” compared to the Street’s expectations.

Given the September trend and weakening order growth, Lutz is incrementally more cautious heading into the next two quarters. The analyst added that the second half of 2025 presents a challenging setup for HIMS, with tougher comparables resulting from the ramp-up of GLP-1 sales in late 2024, churn in the sexual health business due to the transition to more chronic solutions, and an increasingly competitive landscape.

Is HIMS Stock a Good Buy?

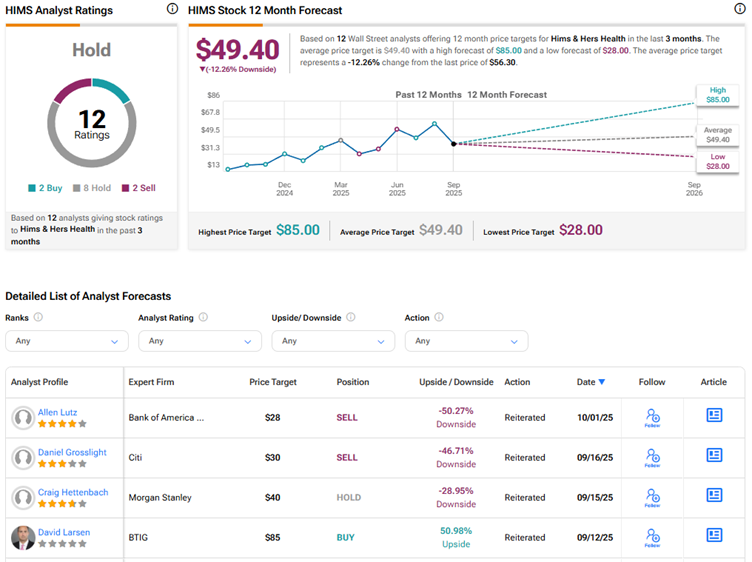

Currently, Wall Street has a Hold consensus rating on Hims & Hers Health stock based on eight Holds, two Buys, and two Sell recommendations. The average HIMS stock price target of $49.40 indicates a possible downside of 12.3% from current levels.