Shares of Bank of America (NYSE:BAC) gained in pre-market trading after the investment bank reported results for the third quarter of Fiscal Year 2023. The bank reported earnings of $0.90 per diluted share as compared to $0.80 per diluted in the same period last year, which beat analysts’ consensus estimate of $0.83 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bank’s revenues increased by 3% year-over-year to $25.2 billion as compared to analysts’ expectations of $25.13 billion. BAC’s net interest income (NII) was up by 4% year-over-year to $614 million, benefitting from higher interest rates and a rise in loans.

Bank of America’s Chair and CEO Brian Moynihan commented, ” We added clients and accounts across all lines of business. We did this in a healthy but slowing economy that saw US consumer spending still ahead of last year but continuing to slow.”

However, the bank’s Consumer Banking deposits declined by 8% in the third quarter to $980 billion, but this business segment posted revenues of $10.5 billion, up by 6% year-over-year.

Is BAC a Good Buy Right Now?

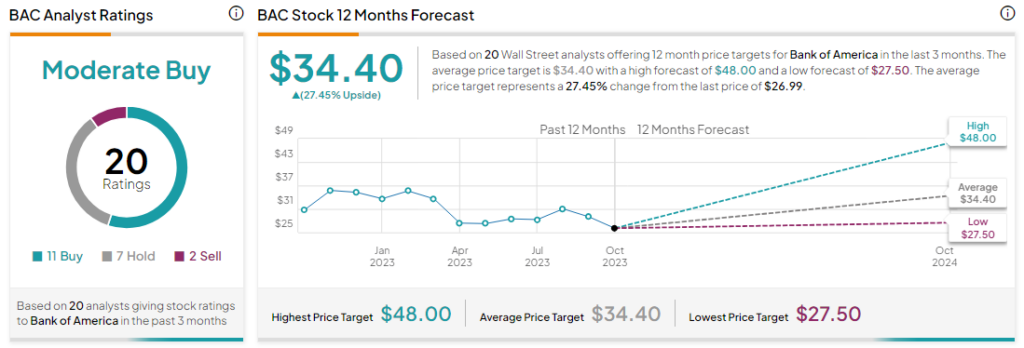

Analysts are cautiously optimistic about BAC stock with a Moderate Buy consensus rating based on 11 Buys, seven Holds, and two Sells. The average BAC price target is $34.40, implying an upside potential of 27.5% at current levels.