Shares of Nvidia (NVDA) are rallying today after Bank of America reiterated its Buy rating on the chipmaker and raised its price target from $165 to $190. Not only that, five-star analyst Vivek Arya called the company a “generational opportunity” that could shape industries for years to come, thanks to its crucial position in the AI industry. Indeed, Nvidia’s products are essential for advanced computing in AI applications like data centers and autonomous vehicles.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, Bank of America pointed out that the demand for AI models is growing fast, as new models from companies like Microsoft-backed OpenAI (MSFT) are now being launched more frequently. Since each new model requires significantly more computing power, the demand for Nvidia’s chips continues to increase. Arya’s confidence is also helped by the fact that other key players in the chip industry have indicated strong AI demand.

Furthermore, Nvidia’s CEO, Jensen Huang, recently pointed to the massive interest in the firm’s AI chip, Blackwell, and called it “insane.” As a result, Bank of America now estimates that Nvidia could generate around $200 billion in free cash flow over the next two years. It’s worth noting that, so far, Arya has enjoyed an 81% success rate on NVDA stock, with an average return of 88.6% per rating.

More than Just a Hardware Company

Although Nvidia is known for its hardware products, the company has been expanding into software as well. In fact, it showcased its growing range of AI software platforms at its AI Summit in Washington, D.C., a couple of weeks ago. By adding software to its product offerings, Nvidia is looking to add a recurring revenue stream while holding on to customers for the long term.

Is NVDA Stock a Buy?

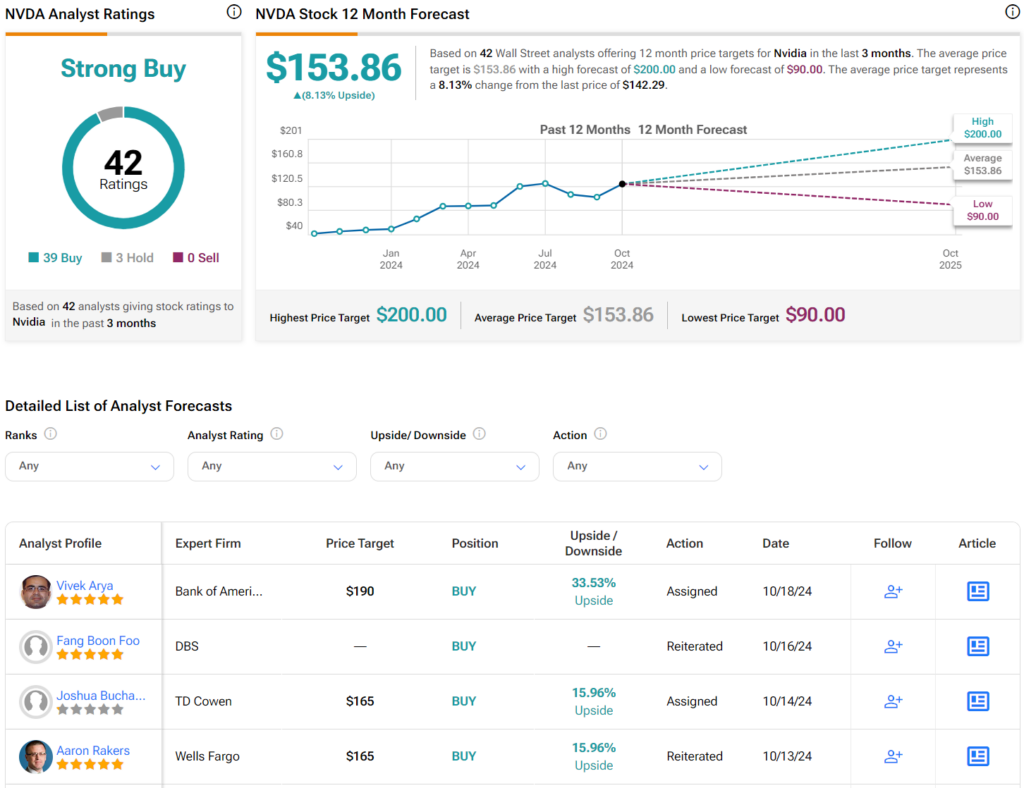

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 231% rally in its share price over the past year, the average NVDA price target of $153.86 per share implies more than 8% upside potential.