Social media giant Pinterest (NYSE:PINS) witnessed a remarkable upswing in trading on Tuesday following its impressive Q3 results that exceeded expectations. Following the results, top-rated Bank of America analyst Justin Post upgraded the stock to a Buy from a Hold.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analyst acknowledged Pinterest’s growth potential compared to its competitors. Post also pointed out that the company’s impending deal with Amazon (AMZN) for third-party ads could result in further acceleration in revenues in the first half of the next year. The analyst added that the company’s improved cost management could result in enhanced margins and EBITDA.

Post commented, “After a year of relative underperformance vs larger peers (both revenue acceleration and stock performance with PINS up 3% vs NASDAQ up 31%), we expect significant focus on Pinterest into 2024 on renewed advertiser traction and impact of new ad partnerships.”

The analyst has a price target of $37 on the stock, implying an upside potential of 25.4% at current levels.

What is the Target Price for PINS?

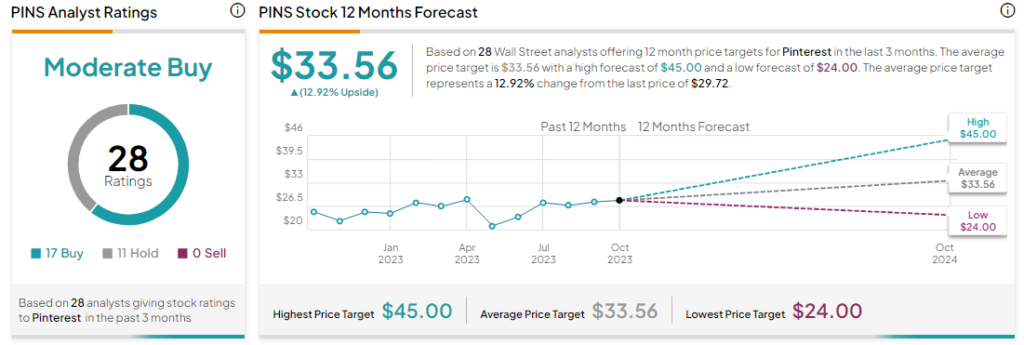

Analysts are cautiously optimistic about PINS stock with a Moderate Buy consensus rating based on 17 Buys and 11 Holds. The average PINS price target of $33.56 implies an upside potential of 12.9% at current levels.