Balfour Beatty (GB:BBY) yesterday posted its half-year results for 2022, with underlying profit from operations increasing by 42% to £85 million, up from £60 million in 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The UK’s construction segment returned to profitability from a loss-making unit in 2021 and posted an operating profit of £18 million.

Danni Hewson, a financial analyst at AJ Bell, said, “Turnaround specialist Leo Quinn continues to make progress at Balfour Beatty, despite rising costs.

“A corporate ‘Mr. Fix-it’, Quinn has positioned the construction services business to take advantage of a resilient infrastructure sector and turned what was a bit of a basket case into an increasingly well-oiled machine.”

The company in a good position to beat 2022’s economic challenges with its future order book value at £17.7 billion. It increased by 10% from 2021, giving the company hope for increased profits and dividend growth.

The market reacted positively to the news, and the company’s shares soared by 10.7% on Wednesday. The shares have gained good momentum in the last six months, with around 35% returns.

What does Balfour Beatty PLC specialise in?

Balfour Beatty is a UK-based group operating in infrastructure investment, construction services, and support services. The company’s investments are spread over various markets and geographies.

It specialises mainly in infrastructure projects in education campuses, highways, health, offshore transmission, renewables, and student accommodation.

Under its support services, the company maintains and upgrades projects in utilities, rail and road, and power transmission.

When did Balfour Beatty last pay a dividend?

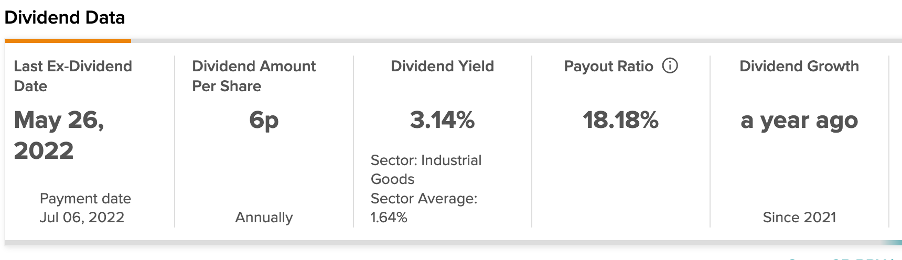

The company paid its last dividends in July 2022 which was 6p per share. The next dividends announced with its results will be paid around four months from now.

Balfour increased its dividends by 17%, to 3.5p per share considering its good performance in the first half. The current dividend payout has increased by around 67%, from 2.1p in the pre-pandemic period.

Leo Quinn, chief executive of Balfour Beatty, said: “With the Group well-positioned to capitalise on the growing infrastructure market, underpinned by its unique capability and balance sheet strength, the upgrade to the full year performance gives the Board further confidence in future capital returns.”

Conclusion

The company is having a good run in its operations despite some headwinds of inflationary pressures in labour and raw materials. It is focusing on large-scale operations and better supply chain management and does not expect inflation to have any impact on its full-year results.

Moreover, the board is confident of further increasing the shareholders’ returns considering its cash position and future projects line-up.