Chinese tech behemoth Baidu (NASDAQ:BIDU) says that the latest version of its generative artificial intelligence (AI) bot, Ernie 4.0, is a direct competitor to OpenAI’s ChatGPT 4 model. Baidu CEO Robin Li launched Ernie 4.0 at the Baidu World 2023 conference held in Beijing today. The CEO boasted the updated software’s abilities to understand, prompt, think, and remember.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

More on the New Ernie Version

Li asked Ernie to write a martial arts novel on the spot and create advertising materials while saying, “Its generalized abilities are by no means inferior compared to GPT-4.”

At the same time, the company announced the integration of generative AI software across all of its product ranges. Li also showcased that Ernie 4.0 now supports natural language queries in its Baidu Maps app. Even so, a Reuters report stated that analysts were not awestruck with the model’s competencies highlighted at the event compared to the earlier version. “We should see significant improvements once Ernie 4.0 is used hands-on, but concrete upgrades aren’t immediately clear,” the report quoted, citing an analyst.

In a bid to capture a larger share of the burgeoning AI market, the Chinese tech sector has created over 130 large language models (LLMs). AI models from Western countries are not officially available in China as regulators have stringent guidelines for them. Also, the mainland seeks to boost its domestic players in the segment as China remains a large consumer base for companies worldwide. Baidu is promoting that its Ernie 4.0 is more advanced than the GPT-4 model, especially in Chinese language capabilities. In April, Chinese e-commerce platform Alibaba’s (NYSE:BABA) Cloud unit unveiled its ChatGPT-like AI model, called Tongyi Qianwen.

What is the Future of BIDU Stock?

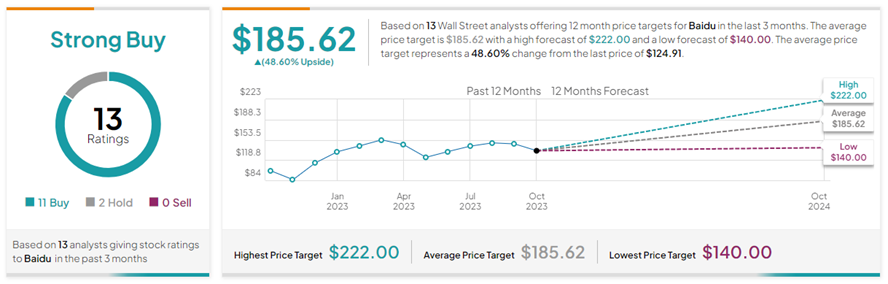

Wall Street is highly optimistic about BIDU’s stock trajectory. On TipRanks, BIDU commands a Strong Buy consensus rating based on 11 Buys and two Hold ratings. The average Baidu price target of $185.62 implies 48.6% upside potential from current levels. Year-to-date, BIDU stock has gained 4.9%.