Chinese artificial intelligence (AI) company Baidu (NASDAQ:BIDU) announced its third-quarter results with adjusted diluted earnings of $2.80 or RMB20.40 per ADS, surpassing consensus estimates of $2.38 per ADS.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s total revenues increased by 6% year-over-year to $4.72 billion or RMB 34.4 billion but fell short of analysts’ estimates of $4.76 billion. More importantly, the Baidu Core business saw its revenues rising by 5% year-over-year to $3.64 billion while its adjusted operating margin stood at 25%.

Baidu’s Core business provides mainly online marketing services, products, and services from new AI initiatives and non-marketing value-added services.

What is the Future of BIDU Stock?

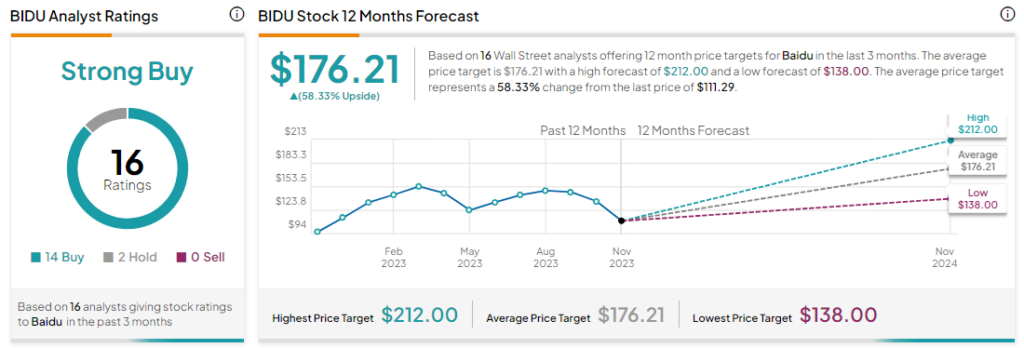

Analysts remain bullish about BIDU stock with a Strong Buy consensus rating based on 14 Buys and two Holds. In the past year, BIDU stock has surged by more than 15% and the average BIDU price target of $176.21 implies an upside potential of 58.3% at current levels.