Baby Bunting Group’s (ASX:BBN) investors fled, as shares fell as much as 26% after the company announced a drop in its first quarter profit. The baby goods retailer blamed the hit on the rising inflation, which the Australian Reserve Bank (RBA) has been working to tame with rapid interest rate hikes.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Baby Bunting reported that its first quarter gross profit margin declined 2.3% compared to the corresponding period a year ago. As a result, the retailer suffered a AU$3 million drop in its net profit after tax for the quarter. Baby Bunting blamed its woes on rising costs, particularly domestic freight charges.

Moreover, adverse movements in foreign exchange rates also weighed on the retailer’s bottom line. A strong U.S. dollar means that importers are paying more for purchases.

Baby Bunting share price prediction

According to TipRanks’ analyst rating consensus, Baby Bunting stock is a Strong Buy. The average Baby Bunting share price forecast of AU$5.85 implies about 90% upside potential.

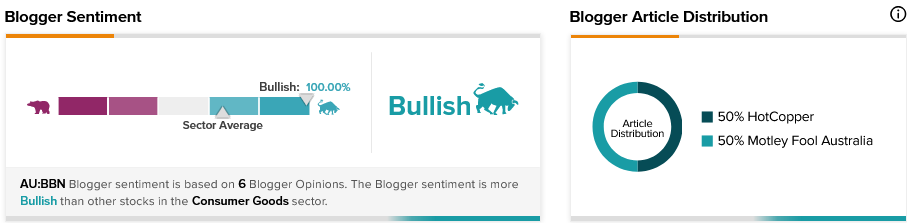

Moreover, Baby Bunting stock is receiving positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on Baby Bunting, compared to a sector average of 66%.

Closing remarks

If the RBA rate hikes help to tame inflation, then companies like Baby Bunting may see a relief in operating cost pressures and increase profit margins. However, retailers like Baby Bunting could see weakened demand for their items if the central bank’s rate increases trigger a recession.