Auto rental and sharing services provider, Avis Budget Group, Inc. (CAR), posted stellar third-quarter results, pushing shares up 6.7% during the extended trading session on November 1. The company witnessed a huge surge in demand for its services, with travel demand picking up pace on the heels of a rebounding economy.

CAR posted adjusted earnings of $10.74 per share, reflecting a staggering growth of 850% year-over-year, significantly higher than the consensus estimates of $6.52 per share.

Similarly, revenues climbed a whopping 96% year-over-year to $3 billion, outpacing Street estimates of $2.71 billion. (See Insiders’ Hot Stocks on TipRanks)

During the quarter, the company witnessed solid growth across all key metrics. Compared to the prior-year quarter, rental days grew 37%, while revenue per day (excluding forex) jumped 42%, and vehicle utilization hit 71.6%.

Commenting on the Q3 results, Joe Ferraro, CEO of Avis Budget said, “Our third-quarter results are a testament to our team’s ongoing focus around cost discipline and ability to execute operationally… We are seeing the benefits of initiatives we began during the early days of the pandemic and look to build on this positive momentum as the travel environment continues to normalize.”

Responding to CAR’s solid performance, Deutsche Bank analyst Chris Woronka reiterated a Hold rating on the stock with a price target of $119, implying 30.6% downside potential to current levels.

Noting that the company’s results outpaced their aggressive forecasts yet again, Woronka said, “CAR’s 3Q EBITDA of $1,057 million topped our $863 million forecast and Bloomberg consensus of $741 million, as revenue came in 2% ahead of our recently raised expectations and fleet costs were a considerably larger tailwind than we contemplated, despite a larger than expected rebuild of the U.S. fleet.”

Having said that, the analyst is looking forward to detailed commentary on key items in the upcoming conference call, which could sway the shares down if investors try to book their profits.

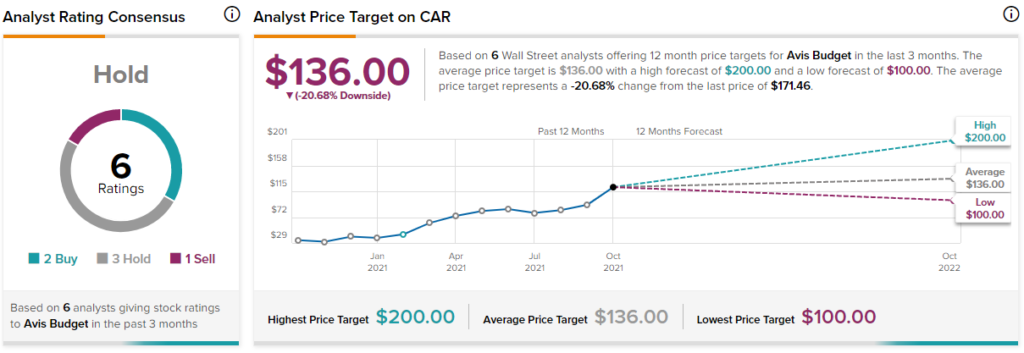

Overall, the stock has a Hold consensus rating based on 2 Buys, 3 Holds, and 1 Sell. The average Avis Budget Group price target of $136 implies 20.68% downside potential to current levels. However, shares have soared 461.8% over the past year.

Related News:

Exxon Mobil Delivers Mixed Q3 Results; Shares Rise

Cerner Q3 Results Exceed Expectations; Shares Up 5%

Mixed Q3 Results Sink Lazard Shares by 6.6%