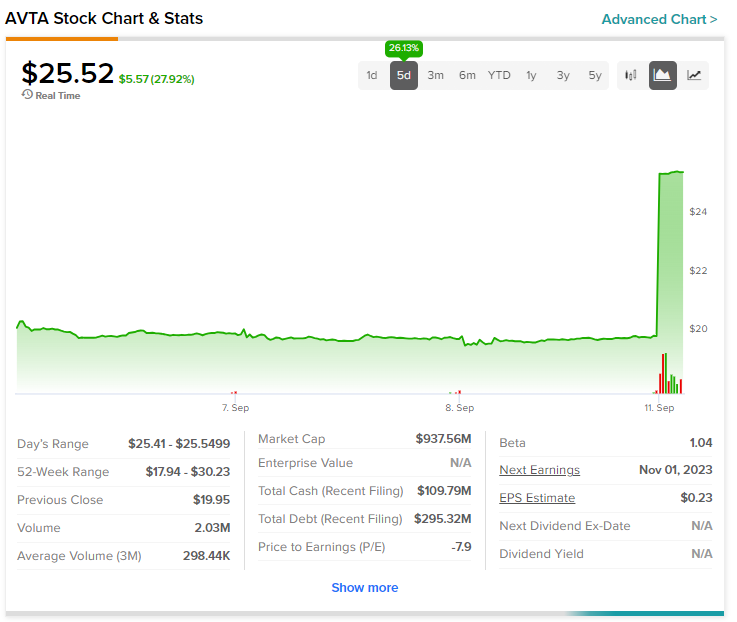

Avantax (NASDAQ:AVTA) shares surged by nearly 26% in the morning session today after the financial planning and wealth management services provider agreed to be acquired by Cetera Financial Group for $26 per share. The total transaction value, including Avantax’s net debt, is estimated at $1.2 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The acquisition price represents a 30% premium over Avantax’s closing price on September 8. At the end of June 2023, the company had $83.8 billion in assets under administration and $42.6 billion in AUM (Assets Under management). Upon the closing of the transaction, Avantax will function as a standalone unit under the Cetera umbrella.

The addition of Avantax is expected to boost Cetera’s capabilities in wealth management and tax planning while also establishing a strategic relationship between Cetera and Fidelity. This, in turn, could help Cetera expand further into a multi-custodial platform.

The transaction has received unanimous approval from Avantax’s Board and is anticipated to close by the end of this year. Upon closing, Avantax will transition into private ownership.

With today’s price gains, Avantax shares have now gained nearly 26% over the past five sessions.

Read full Disclosure