Shares of Autoliv (ALV) dropped 4.8% to $90.44 on July 16 after the Sweden-based automotive safety supplier reported worse-than-expected Q2 results, missing both earnings and revenue estimates. The miss was attributable to lower customer demand, continually increasing raw material prices, and semiconductors supply shortages.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company reported adjusted earnings of $1.20 per share, lagging analysts’ expectations of $1.48 per share. Net Sales of $2.02 billion fell short of the consensus estimate of $2.13 billion.

Notably, net sales grew 93% on a year-over-year basis, driven by robust organic sales growth of 85% as a result of launches and positive vehicle and geographical mix effects.

The company reported a loss of $1.40 per share in the prior-year period. (See Autoliv stock charts on TipRanks)

Autoliv CEO Mikael Bratt commented, “We also continue to drive forward with our strategic initiatives, such as increased digitalization and automation of the value chain, which are yielding good results.”

He further added, “Our internal progress and a light vehicle market outlook with a production recovery in the next few years makes us confident of our 2022-24 targets of average annual 4-5% growth over LVP and 12% adjusted operating margin. We will elaborate on this and our long-term opportunities at our virtual CMD on November 16, 2021.”

Based on the ongoing demand and supply chain uncertainty, the company updated its full-year guidance. The company forecasts organic sales growth of 16 – 18%, with an adjusted operating margin in the range of 9% – 9.5%.

Management said that raw material prices have been rising consistently. Furthermore, prices of certain key commodities have risen over 20% in the past three months. It forecasts the increased prices to negatively impact operating margins by 130 bps for the full year.

Following the results announcement, Mizuho Securities analyst Vijay Rakesh maintained a Buy rating with the price target of $112 (23.8% upside potential) on the stock.

Rakesh forecast Autoliv to report earnings of $1.79 per share in the upcoming third quarter of 2021.

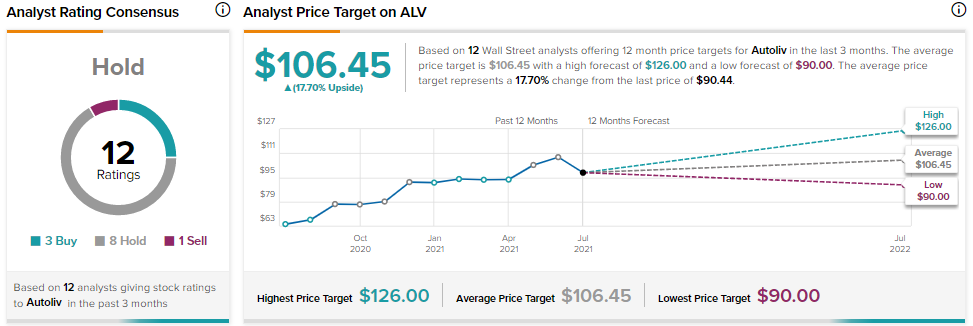

Currently, the Street is sidelined on the stock. The Hold analyst consensus rating is based on 8 Holds, 3 Buys, and 1 Sell. The average Autoliv price target of $106.45 implies upside potential of 17.70% to current levels. Shares have jumped 37% over the past year.

Related News:

U.S. Bancorp Tops Q2 Estimates, Shares Bounce 3.2%

WNS Posts Upbeat Results, Raises Guidance

Walmart Launches Justice Brand’s Comeback