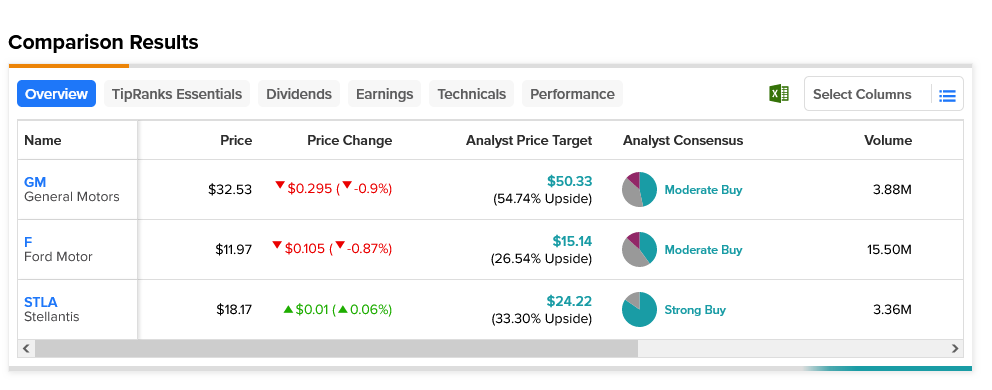

It’s T-minus one week until what may be the biggest strike the major auto makers—Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA)—have seen in a long time. Ford and GM are down slightly in Thursday afternoon’s trading, and Stellantis is up fractionally as negotiations fire up in earnest in a valiant attempt to maintain status quo.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The proposals are flying back and forth, as the UAW offered up a counterproposal to Ford’s recent proposal, and Stellantis will step in with a counteroffer of its own later this week. Later today, GM execs will sit down with UAW reps in a bid to hack out their own agreements.The union seems to be maintaining most of its earlier demands, including a 32-hour work week that’s paid as if it were 40 hours, pensions for new hires, expanded healthcare, and a 46% pay raise over the next four years.

Some are already taking up predictive positions about what will happen. The Detroit News, not surprisingly, came out with its own slate, including that the union will ultimately have to back down on some of its demands. But one analyst looked for the cost-of-living hikes to go through. Meanwhile, AutoForecast Solutions’ Sam Fiorani noted that even a month’s striking by UAW and Unifor (the Canadian equivalent) would produce a hole in inventory that couldn’t be made up before 2024 arrived.

Meanwhile, the Big Three pose rather different prospects for investors. Only Stellantis is considered a Strong Buy by analysts; Ford and GM are merely Moderate Buys. Despite this, analysts expect the most from GM and the least from Ford. GM’s average price target of $50.33 gives it 54.74% upside potential, while Ford’s $15.14 average price target puts its upside potential at just under half that at 26.54%.