Remember when the union at UPS (NYSE:UPS) was potentially going on strike? It might be about to get worse, as United Auto Workers members consider a possible strike. That sent shares of Ford (NYSE:F) down fractionally, while General Motors (NYSE:GM) and Stellantis (NYSE:STLA) both amazingly managed to gain in Monday afternoon’s trading as a potentially multi-billion-dollar disaster loomed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The vote is expected to start this week, and the results of the vote will be announced Thursday. A Strike Assistance Conference has already been called, and details of the strike are already packaged up and ready to go ahead of a vote. The three major automakers who will be impacted by the said strike have already called for more talks, though it’s not clear just how much more talking the UAW will be looking to do.

Should the strike go through, notes Anderson Economic Group, the price tag will run the automotive industry over $5 billion. However, should the UAW get what it wants, the price tag might be almost as large. A look at the union’s written demands, as expressed by the Detroit News, notes that the UAW has already asked for a 46% wage increase to be phased in over the next four years. That’s the biggest increase seen in years, if not decades, and would tack a good slug of cash onto the price of a car. Further, the union also plans to pursue a 32-hour work week, which will make new cars that much harder to come by.

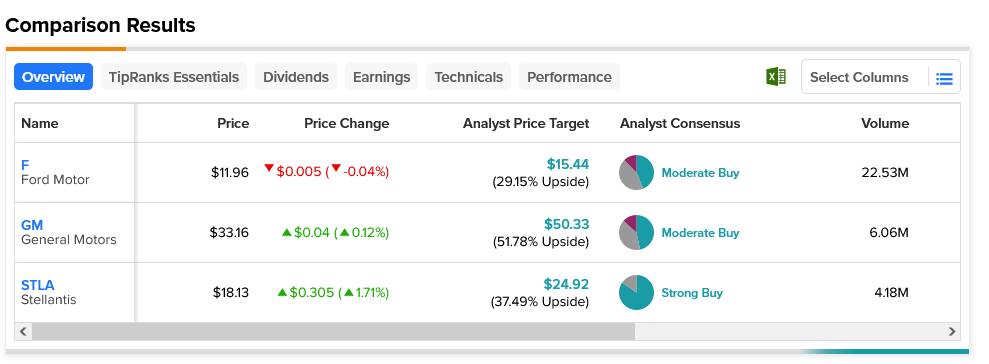

While the picture was oddly mixed on this potentially dire news, it was the lone loser and the slight gainer that represent the extremes of potential return for investors. Both Ford and GM are considered Moderate Buys. Ford, however, only has a 29.42% upside potential thanks to its $15.44 average price target. Meanwhile, GM boasts a 52.33% upside potential with its $50.33 average price target.