The Global X U.S. Adaptive Factor ETF (NYSEARCA:AUSF) looks like an enticing choice for investors in this volatile market environment, as it can help reduce portfolio volatility. After a big year in 2023 and a strong start to 2024, the stock market has recently become more turbulent amid concerns about stubborn inflation, the growing likelihood that interest rates will remain higher for longer, and persistent geopolitical tensions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on this multifactor ETF from Global X based on the defensive mettle it showed during the last bear market, the attractive valuation of its portfolio, and the strong ratings its top holdings receive from Tipranks’ Smart Score system.

Furthermore, AUSF has generated a solid overall performance over the last three and five years, with total annualized returns of 15.3% and 14.3%, respectively, over each time frame (as of March 31), so while it gives investors some downside protection, it doesn’t mean that it can’t produce solid upside as well.

What Is the AUSF ETF’s Strategy?

According to fund sponsor Global X, AUSF “seeks to outperform traditional market capitalization weighted indexes by allocating across three factors – minimum volatility, value, and momentum – that have historically demonstrated advantages compared to broad benchmark indexes.”

Bear-Beating Performance

AUSF has indeed outperformed the broader market over the past three years, but it hasn’t quite outperformed it over the past five years. Still, it held up much better than the broader market during the 2022 bear market, as we’ll discuss further below.

As of March 31, AUSF has also posted an annualized three-year return of 15.3%, soundly outperforming the broader market in the process. The Vanguard S&P 500 ETF (NYSEARCA:VOO) produced an 11.4% annualized return over the same time frame.

Over the past five years, AUSF has lagged the broad market ETF by a narrow margin with an annualized return of 14.3% versus VOO’s annualized return of 15.0%.

Despite this slight underperformance, this is still a very respectable return profile, as double-digit annualized returns are nothing to sneeze at.

Given the decidedly lower valuation of AUSF’s holdings and its lower beta, this small gap in performance compared to the S&P 500 (SPX) seems palatable. If the broader market goes through a downturn, AUSF may hold up better.

Indeed, AUSF has demonstrated its defensive mettle during previous bear markets. For example, during the 2022 bear market, VOO fell 18.2% for the year. Remarkably, AUSF emerged from the 2022 bear market more or less unscathed, with a barely noticeable loss of just 0.2% for the year.

Now, the tradeoff here is that AUSF underperformed VOO during 2023 when the bull market came roaring back, but it wasn’t by a wide margin. AUSF produced a total return of 22.4% for the year, which slightly underperformed VOO’s 26.3% total return. Still, a 22.4% gain is very respectable, especially for an ETF that held up so well during the downturn the year before.

On this front, it’s also worth pointing out that AUSF has a low beta of 0.75.

Global X defines beta as “the volatility of a fund’s price relative to the volatility in the market index and can also be described as the percent change in the price of the fund given a 1% change in the market index.” A beta of below 1.0 means that the ETF was less volatile than the market benchmark. Therefore, AUSF’s beta of 0.75 indicates that the fund was about one-quarter less volatile than the S&P 500, exposing investors to significantly less volatility.

While this may mean that the fund’s returns are a bit more muted during a roaring bull market, it can give investors some protection and peace of mind during a market downturn and thus make AUSF an attractive choice for risk-averse investors or investors concerned that the market has become overheated.

AUSF’s Holdings

AUSF provides investors with excellent diversification and leaves them with very little concentration risk — the ETF owns 192 different stocks, and its top 10 holdings make up just a minuscule 17.3% of assets.

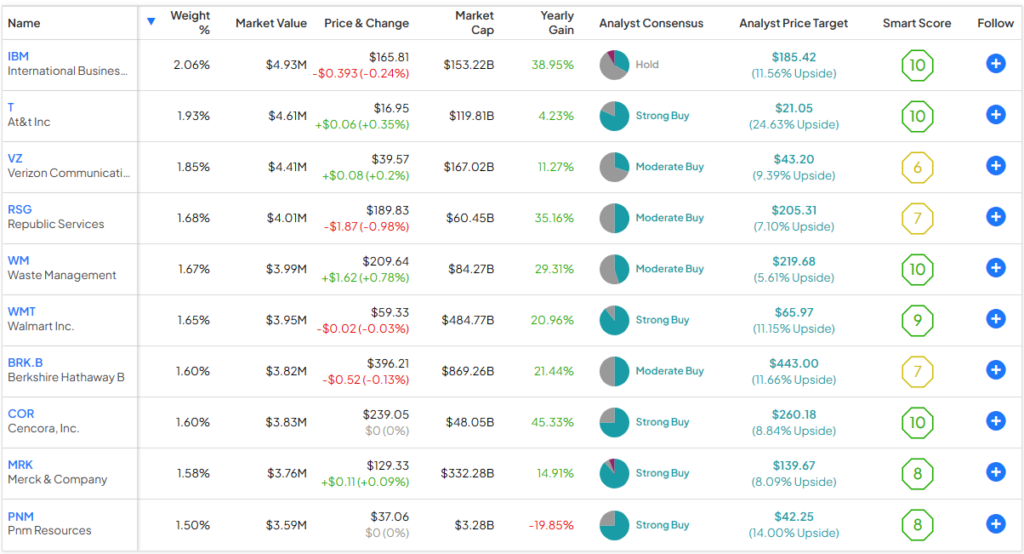

Below, you’ll find a table of AUSF’s top 10 holdings from TipRanks’ holdings tool.

While you won’t find the “Magnificent Seven” names that seem to dominate the top holdings of many other ETFs, you’ll find a strong group of well-known, high-profile blue-chip stocks with sterling Smart Scores.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Not only do an impressive seven out of AUSF’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or better, but its top two holdings, IBM (NYSE:IBM) and AT&T (NYSE:T), boast ‘Perfect 10’ Smart Scores, as do Cencora (NYSE:COR) and Waste Management (NYSE:WM).

AUSF is focused on value, and another attractive aspect of its portfolio is that its holdings are quite inexpensive when compared to the broader market.

The S&P 500 trades at 22.3 times earnings, whereas the average price-to-earnings ratio for AUSF’s holdings is a much more modest 12.1 times. This undemanding valuation should give AUSF investors more downside protection than investing in the S&P 500 and could also leave more room for upside on the table, as the valuations for AUSF’s holdings can’t be called overextended.

AUSF also offers investors ample diversification across market sectors — the fund’s heaviest exposure is to financials, with a weighting of 22.6%. This is followed by information technology, which has a weighting of 14.8%, health care (11.8%), and consumer staples (10.2%).

Does AUSF Pay a Dividend?

While it’s not the main draw here, AUSF is a dividend payer, and the ETF currently yields 1.8%.

Moderate Expense Ratio

AUSF charges a moderate expense ratio of 0.27%, meaning that an investor putting $10,000 into the ETF will pay $27 in fees on an annual basis.

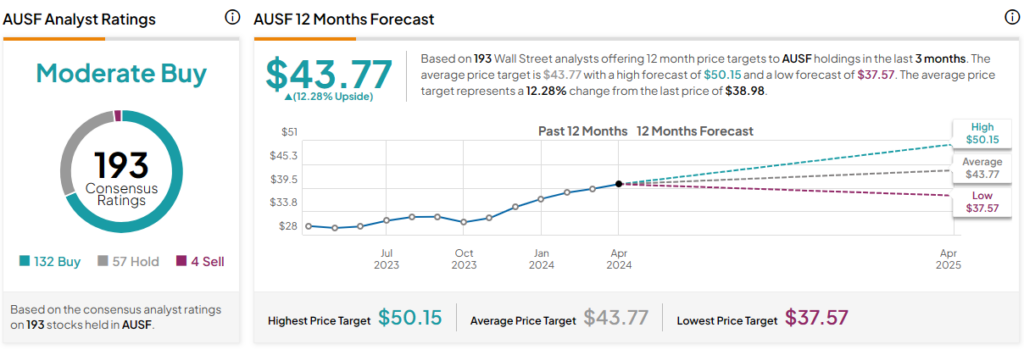

Is AUSF Stock a Buy, According to Analysts?

Turning to Wall Street, AUSF earns a Moderate Buy consensus rating based on 132 Buys, 57 Holds, and four Sell ratings assigned in the past three months. The average AUSF stock price target of $43.77 implies 12.3% upside potential.

The Takeaway

In conclusion, AUSF isn’t likely to blow the doors off the market or generate exponential returns. But its performance during recent market downturns illustrates its defensive value, and this track record, combined with the inexpensive valuations of its holdings, means it should offer decent downside protection again going forward.

AUSF has also managed to produce double-digit annualized returns over the past three and five years, so it’s not as if investors are depriving themselves of upside by holding it.

In conclusion, I’m bullish on AUSF based on its defensive chops, its solid long-term performance, the inexpensive valuation of its highly-rated portfolio, and its reasonable expense ratio.