Shares of cannabis products provider Aurora Cannabis (NASDAQ:ACB) are on the rise today after receiving approval to transfer the listing of its shares to the Nasdaq Capital Market from the Nasdaq Global Select Market, effective today.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this transfer, Aurora can now seek an additional 180 days to regain compliance with Nasdaq’s minimum price listing requirement. The company’s shares have fallen by nearly 38.6% over the past year to the current $0.90 level.

Further, the company is repurchasing its convertible senior notes at a total cost of $13 million by issuing nearly 13.5 million shares. Following this transaction, its outstanding notes will stand at about $39.6 million. The company has bought back approximately $428 million (in principal amount) of its notes since December 2021. Aurora is aiming to achieve positive free cash flow in 2024, and lowering its interest payments should help it get there.

What Is the Prediction for ACB Stock?

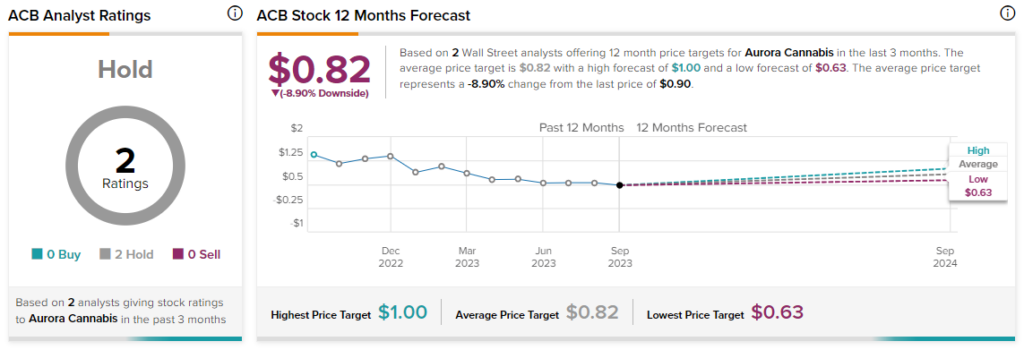

Overall, the Street has a consensus price target of $0.82 on Aurora, alongside a Hold consensus rating. This implies a potential downside of 8.9%.

Read full Disclosure