AT&T (NYSE:T) and Verizon (NYSE:VZ) are two of the biggest names in telecom stocks around. But while they’ve been major names for some time, some of their past is coming back to haunt them. Both are up slightly in Monday afternoon’s trading, but there’s one major problem coming back to haunt the duo: its own telephone lines. Back when phone lines were getting started, and the country was only just getting to know the phone phenomenon, utility companies would coat their copper lines in lead before burying them in the ground. That, as we all know today, is actually a huge problem. So now, the modern telecom turns to plastic and other insulators. But what does it do about the lead? The answers that have arisen are so far not welcome ones.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Yet the answers may not be so crippling as some expected. Early reports pegged the costs to remove lead and upgrade systems at around $60 billion, with AT&T alone on the hook for over half that at $35 billion. Verizon was in for $8 billion. However, updated reports now suggest those prices are way too high, with AT&T more likely on the hook for $7 billion and Verizon closer to $1 billion. Of course, that’s just for remediation costs, not any lawsuits that might emerge. But given the considerably low concentration of lead involved, those costs should be manageable as well, particularly for two companies expected to average a combined $35 billion a year in free cash flow.

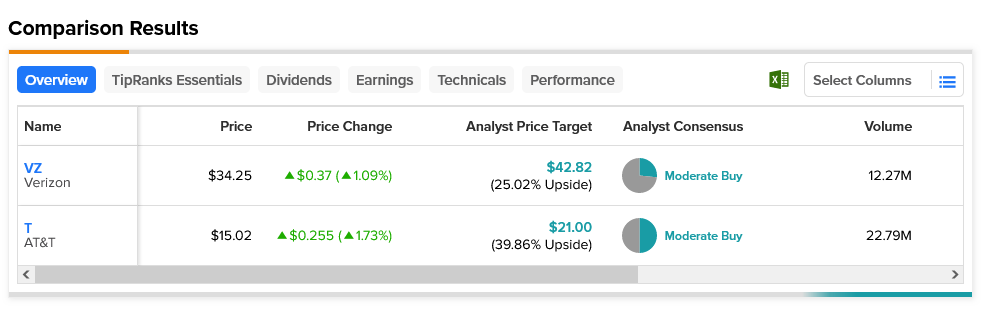

Both stocks are looking like reasonably good ideas, particularly since analysts consider both as Moderate Buys. AT&T, however, has better upside potential at 39.86% thanks to an average price target of $21, whereas Verizon offers 25.02% upside on an average price target of $42.82.