Good news for AT&T (T) today as the telecom giant set up a new deal with Nokia (NOK) following its loss of a previous contract to Ericsson. The new deal will give AT&T some new fiber in its diet and expand its reach substantially. AT&T added over 1.5% in Tuesday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The deal in question comes after some recent moves and countermoves; Nokia had previously lost a contract with AT&T to Ericsson. AT&T originally chose Ericsson to help build a new telecom network that would cover 70% of AT&T’s wireless traffic by the end of 2026.

Now, Nokia is stepping in to make its own arrangement with AT&T, setting up a five-year deal for fiber coverage with AT&T. Though Nokia did not put a price tag on the deal, it noted that the deal represented “a significant milestone.” By way of comparison, the Ericsson deal, which also went on for five years, was valued at around $14 billion. If the Nokia deal is comparable, it does suggest a price within this range.

Labor Troubles

Meanwhile, AT&T has a new problem on its hands: labor issues. The Communications Workers of America recently pulled out of mediation talks with AT&T, declaring that AT&T was using the mediation process as “…another delaying tactic.” That means over 17,000 workers—ranging from technicians to customer service—will remain on strike, which started up last month.

AT&T, for its part, took the high road in response, declaring that “…progress will not be made without a willingness to compromise.” This is true, and so far, the impact has been comparatively light. AT&T also noted that it would continue with backup plans to ensure that all its bases are covered and service continues uninterrupted.

Is AT&T a Buy, Sell, or Hold?

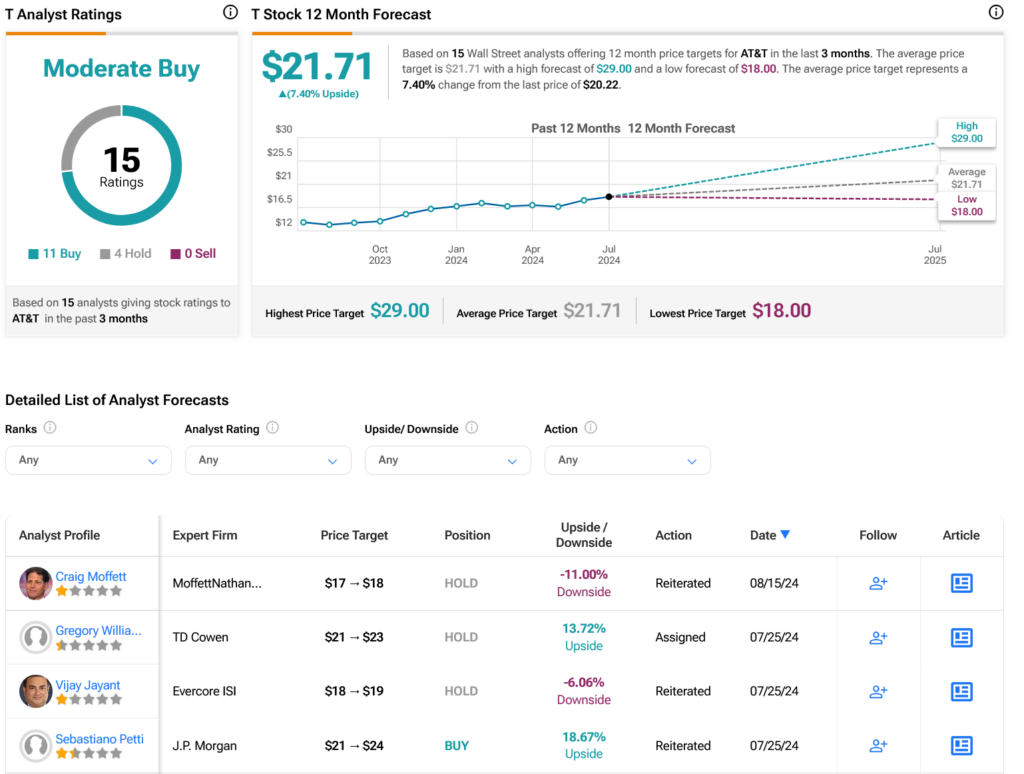

Turning to Wall Street, analysts have a Moderate Buy consensus rating on T stock based on 11 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 49.45% rally in its share price over the past year, the average T price target of $21.71 per share implies 7.4% upside potential.