Telecom giant AT&T (NYSE:T) is exploring options for its 70% ownership in DirecTV, as reported by Bloomberg. The move comes when the company is nearing the end of an agreement allowing it to divest its stake in DirecTV legally.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The acquisition of DirecTV turned out to be a regrettable move for AT&T. Back in 2015, AT&T acquired the digital television entertainment services provider for a staggering $67 billion, including its debts. Unfortunately, much like its competitors, DirecTV witnessed a steady decline in its subscriber base, which significantly diminished its overall worth.

As DirecTV struggled to reduce churn, AT&T entered into an agreement with TPG, a private equity firm, to execute the spin-off of DirecTV. The transaction resulted in the creation of a new entity named DirecTV, which encompassed not only DirecTV but also AT&T TV and the U-Verse business. The deal was completed in August 2021, with AT&T receiving $7.1 billion in cash while retaining a 70% ownership stake in the newly formed company.

AT&T is evaluating various alternatives as the company approaches the end of its agreement that prevented it from divesting its stake in DirecTV. These options include selling its stake, bringing in new investors, or pursuing a dividend recapitalization strategy. However, the specific course of action AT&T will take is uncertain.

In the meantime, let’s look at what the Street recommends for its shares.

Is AT&T Stock a Buy or a Hold?

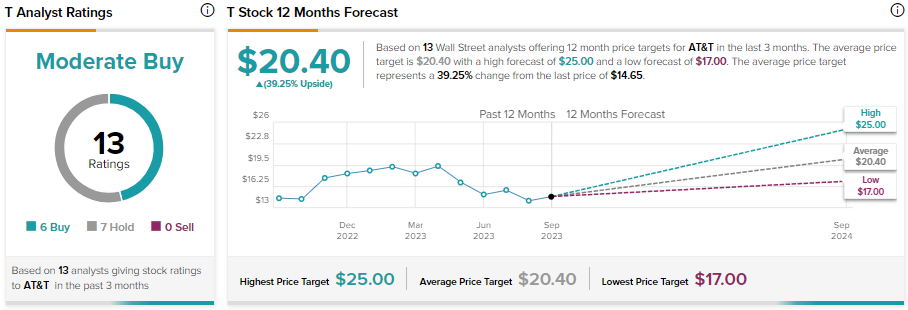

Wall Street analysts are cautiously optimistic about AT&T stock. The company is focusing on expanding its 5G services, which will drive its customer base. However, increased competition in the wireless segment and persistently high interest rates remain a short-term drag.

With six Buy and seven Hold recommendations, AT&T stock has a Moderate Buy consensus rating. At the same time, analysts’ average price target of $20.40 implies 39.25% upside potential from current levels.